By Devon Speas, Principal, Circana

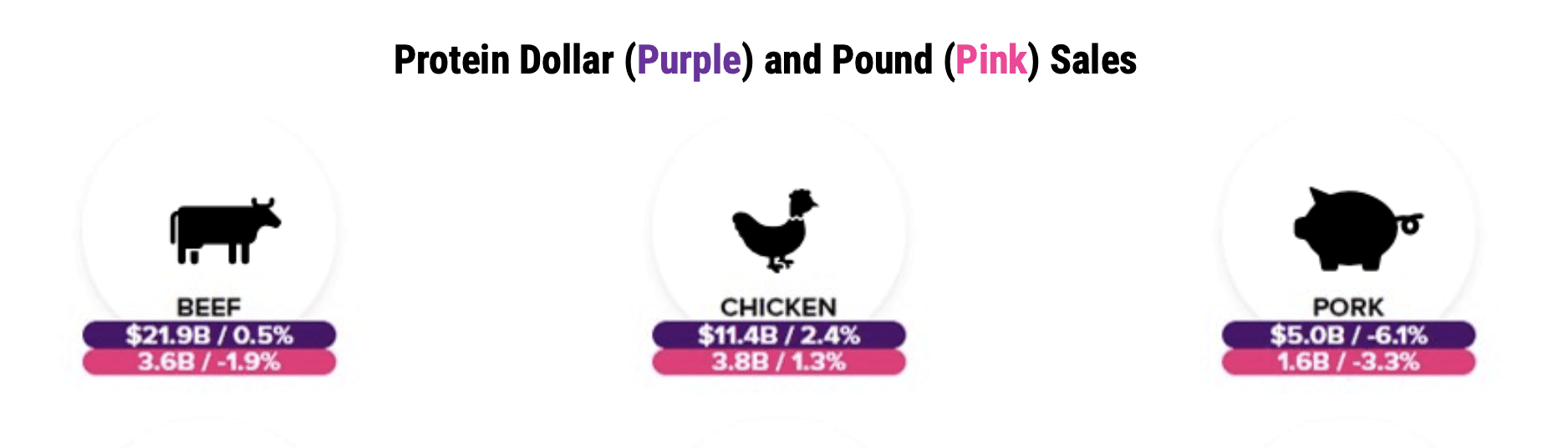

Despite easing inflation, consumers still face significant financial pressures from rising consumer credit costs, shrinking savings, and growing average household debt. In this environment, they are cutting costs by dining out less often and sourcing 86% of their meals from retail. Perhaps unsurprisingly, they’re also buying more chicken, the lowest-priced of the “big three” proteins.

Our March 2023 National Eating Trends® report notes consumers preparing dinners at home increasingly prefer one-dish meals, dinners that take less time, and meals that require little or no preparation. Chicken complements this trend because it’s easy to prepare, hard to overcook, and versatile.

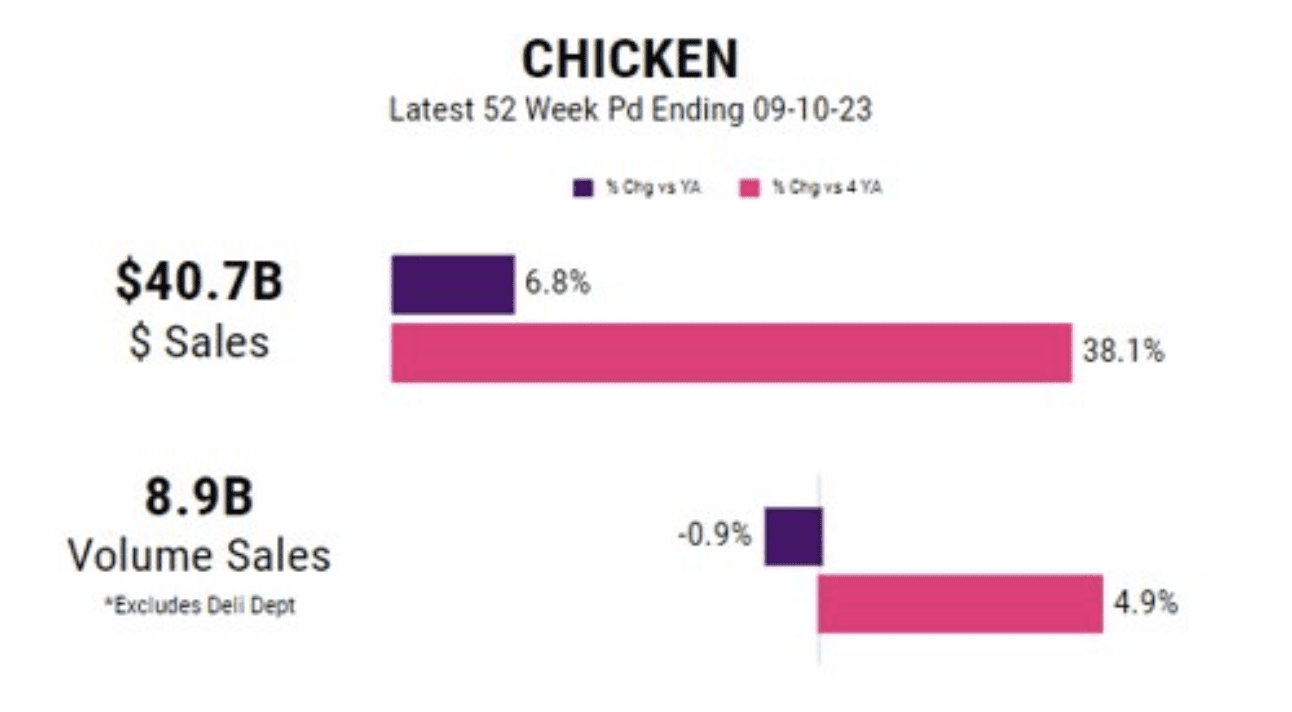

Propelled by these value and convenience benefits, chicken now approaches $41 billion in annual U.S. retail sales — with more pounds and far more dollars sold than pre-pandemic.

Source: Circana, Integrated Fresh Market Advantage, MULO, YTD through September 10, 2023

In fact, chicken now outsells all other proteins in total pounds, and is also the only protein currently posting positive volume growth.

Source: Circana, Integrated Fresh Market Advantage, MULO, YTD through September 10, 2023

Pound sales for chicken have doubled over the past 20 years, buoyed by these factors and by other benefits such as its leanness and high protein concentration. For suppliers, operators, and retailers, chicken’s eight-week maturation time also facilitates agility in pricing, supply, and planning.

Beyond retail, quick service restaurants (QSRs) are seeing success with their chicken offerings too. But there’s a big gap between chicken’s performance at QSR versus full service restaurants (FSRs). The number of QSR chicken servings is seven times the chicken servings in FSRs. And for the 12 months ending August 2023, QSR chicken servings grew 5%, while FSR servings declined 2.2%.

This can be attributed, in part, to QSRs upping their chicken sandwich game with new offerings, motivated by the margin potential of the lower-cost protein. But it may also reflect chicken’s position as an everyday staple, and of people’s willingness to splurge on more costly cuts of meat when they’re out for a special FSR meal.

To make the most of chicken, it’s important to understand its role in our diets and how people shop for it. Today, U.S. households average 10 more retail trips for food annually than they did in 2019. They’re doing just-in-time shopping for tonight’s meal as opposed to stocking up. When they shop, retailer apps are more popular than paper circulars.

As these trends converge, lifts from promotion on chicken have been eroding. When manufacturers do sell on promotion, they need to get retailer-specific and responsive to new shopping patterns. That includes offering more deals through retailer digital apps and understanding that options like BOGO offers on chicken don’t work as well anymore.

What can work is cross-selling — whether that’s with other higher-cost proteins, with sides that can contribute to convenient meal solutions, or even with other chicken products. A look at our data for the 13 weeks ending August 13, 2023, found shoppers who buy chicken often buy it in several forms during a single trip. For example, among shoppers who bought ready-to-eat rotisserie chicken, 71% also bought raw chicken, 38% bought frozen processed chicken, and 6% bought pre-marinated chicken.

Retailers should also strategically weigh how much margin they want to take on chicken against how much price relief they want to give to consumers. Given chicken’s role as a trip driver, competitive pricing is often better if it brings shoppers to your store instead of to the one around the corner.

As chicken sales continue their upward trajectory, we also see tailwinds ahead for the overall meat category and for the total store. Getting your pricing, promotion, and assortment right on core staples like chicken can be a foundational element for success in these efforts.

Contact us today to learn how our sales data, protein expertise, and measurement and forecasting capabilities can help you maximize your chicken and total-store performance.

Get insights straight to your inbox