Michelle Bennett

Michelle.bennett@circana.com

Ensure that below-the-brand insights are not biased, incomplete, or overweighted.

Limited and Varying Receipt Information Skews Below-The-Brand Insights

Brands need accurate insights into the retail performance of their products at the item level to truly understand consumer purchasing behavior and make the best possible business decisions. Incorrect data can impact brand performance, sacrificing margins and credibility. For many key business decisions, it is helpful to understand how different product attributes drive consumer behavior. This requires the ability to classify items at a granular level.

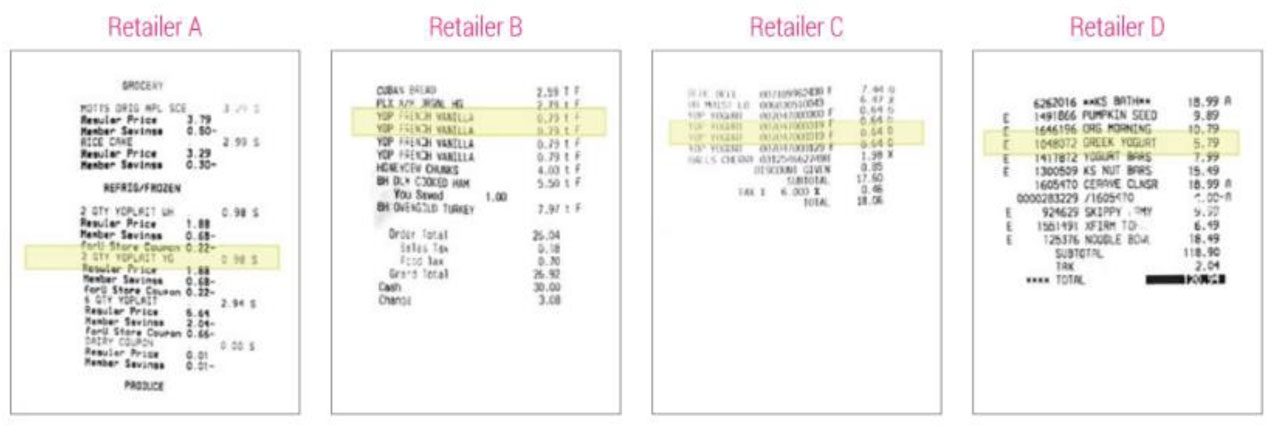

As you move through a product hierarchy, you may, at a high level, describe a product simply as yogurt. But a more granular look will tell you more: brand name, eight-ounce, strawberry, six-pack. Receipt-panel-only providers may claim to deliver insights based on granular product attributes. However, because of the limited and varying information available on receipts, granular below-the-brand attributes cannot be consistently and reliable built from stand- alone receipt data.

Cherry Picking Is Not An Accurate Approach

When all you have to work with are receipts that vary widely in their level of product detail, one solution a provider may use is a “cherry-pick” approach – choose the receipts that do contain the necessary product information and exclude those that do not. But the drawbacks of this approach are many – and can have serious ramifications. Relying on this patchwork information could result in:

- Insights that are incomplete, biased and overweighted toward purchases at retailers offering more detailed receipts. This is problematic because the shoppers and product assortments can be quite different at a mass retailer that offers UPC-level detail vs. a club store that does not

Across all U.S. brick-and-mortar retailers, fewer than 50% of all transaction receipts include UPC-level details. Many include far more limited or high-level product information, making it impossible to accurately create the product hierarchies that are necessary for reliable below-the-brand insights.

- A partial view of the market that does not accurately track sales at the item level. This reduces the value of these consumer insights as a diagnostic tool for market performance.

- A large – and largely useless – “All Other” product bucket containing the transactions that cannot be clearly identified.

These issues can snowball as they combine and result in questionable decisions based on potentially distorted insights. This inevitably leads to eroding credibility with retailers who have a deep understanding of their shoppers

A Better Way

You simply cannot get a complete omnichannel read of below-the-brand attributes solely from a standalone receipt panel. But insights without compromise ARE possible

The smarter approach is to combine a broad receipt panel with below-the-brand information from a scan panel. This approach uses UPC-level data that is aligned to actual POS sales. The receipt panel provides insights down to the brand level, while the scan panel is used for the most granular below-the-brand insights. Having item-level data allows you to connect the exact products purchased in each transaction with thousands of attributes available in a master item dictionary.

With this approach, you can confidently develop insights into how product attributes drive consumer decisions. The scan panel and receipt panel together provide the most complete and accurate consumer and brand insights. More accurate information drives better insights at the item level, product level, and brand level.

Make decisions with confidence and strengthen retail relationships with insights that accurately represent what shoppers are purchasing in their stores.

With Circana’s Complete Consumer, you never have to compromise. The Circana Scan Panel gives you an understanding of what was in every single transaction, along with the ability to connect these purchases to the thousands of attributes in our master item dictionary. The Circana Receipt Panel complements these insights with the broader channel coverage that only a receipt panel can provide. Both are combined into a single seamless analysis within Circana’s industry-leading Liquid Data ® platform for a complete view to make decisions with confidence.

Product Descriptions Vary Extensively by Retailer and Key Attributes Often Aren’t Included on Receipts

Get insights straight to your inbox