Home > Insights > Press Releases > Auto Aftermarket Forecast Softening as Rising Prices Erode Demand, Reports NPD

Port Washington, N.Y., September 28, 2022 – The 30% rise in U.S. automotive aftermarket average selling prices so far this year, compared to 2019, is not expected to sustain retail sales revenue in the industry, as it has up to this point. In fact, both high and low-income consumers are shifting spending away from DIY auto care. Without a boost to unit demand, industry sales revenue from retail front-room products like paint, spark plugs, tires, wipers, motor oil, and other key aftermarket categories will continue to soften into 2023, according to the latest “Future of Auto” forecast from The NPD Group, which recently merged with Information Resources, Inc. (IRI).

“The automotive aftermarket is in a tug of war between the headwinds and tailwinds swirling in the consumer’s economic existence,” said Nathan Shipley, automotive industry analyst for NPD. “Caught between mobility needs and elevated prices, consumers have moved from a mindset of getting what they need when they need it, to one of prioritized spending and making do.”

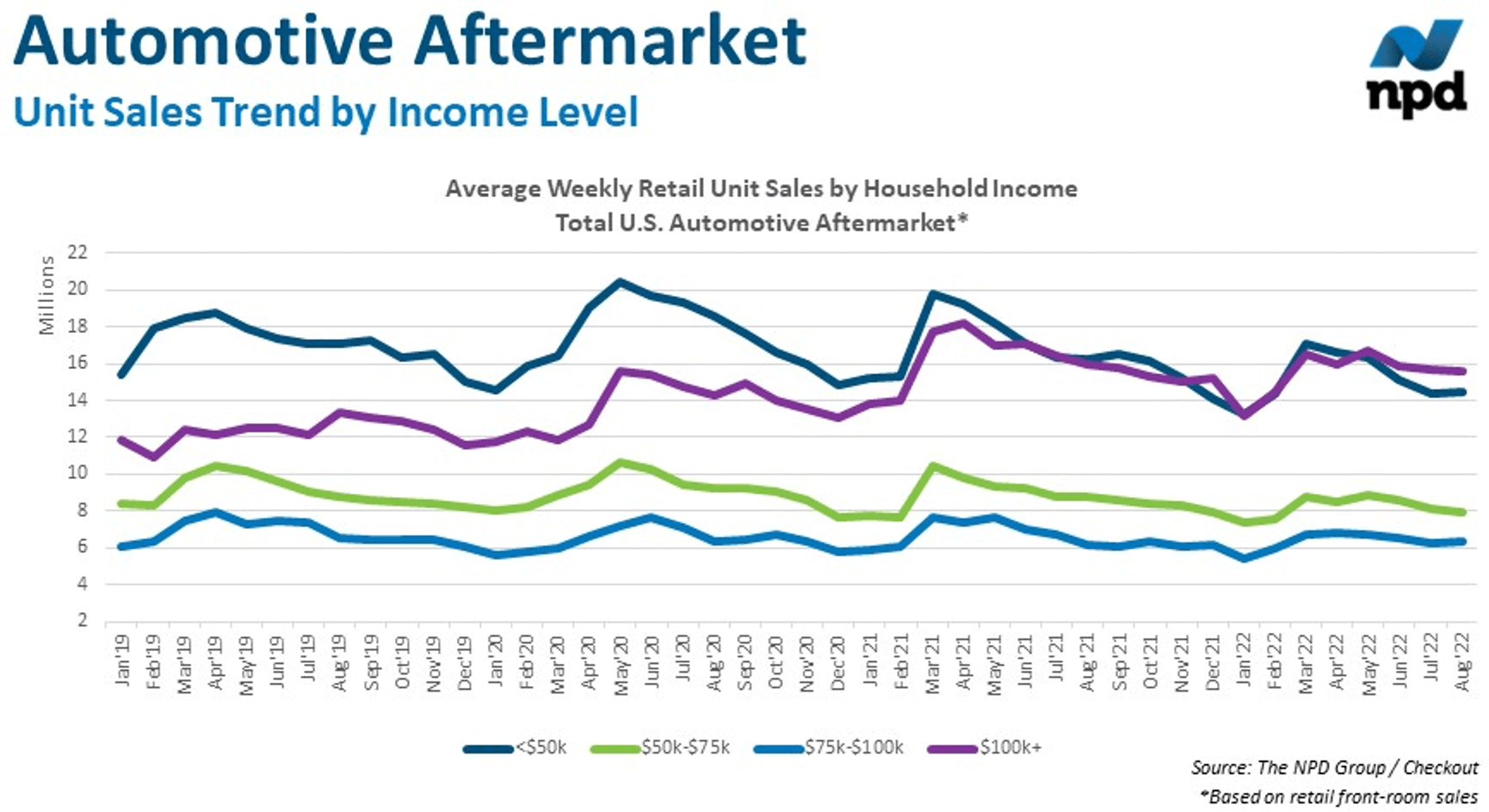

Lower-income households earning less than $50,000 a year have historically been the most important to the DIY automotive categories, but there has been some erosion within this consumer cohort. Low-income earners are deferring automotive maintenance to stretch their income which is being squeezed by higher prices on basics like food, gas, and rent. High-income households making more than $100,000 per year contributed nearly all the aftermarket growth over the past few years, but these consumers are now redirecting discretionary dollars. These high-income earners are more focused on experiential categories related to things like traveling, experiences, and extracurricular activities for their children, rather than spending on the do-it-yourself auto care activities they engaged in during the pandemic.

The aftermarket has long benefitted from an aging vehicle population and other favorable macroeconomic effects, and the pandemic helped create several new ones. Both new and used car inventory shortages have caused a favorable shift in vehicle demand, helping put more vehicles in the sweet spot, fewer vehicles under their original equipment warranty, and an increase in the overall average age of the U.S. fleet.

Additionally, the use of public transit and air travel are still below pre-pandemic levels; however, the number of miles driven and gasoline demand are also falling below 2019 benchmarks. Discretionary spending is being pulled in different directions as consumers reengage in more in-person activities and feel the squeeze of rising food and gas prices. A recent NPD survey revealed that more than three-quarters of consumers plan to cut back on their spending due to inflation — with little variation between high- and low-income brackets. While automotive products are near the bottom of the list of items consumers plan to cut spending on, lower income consumers are more likely to be behind this movement.

“The consumer behavior during the pandemic shifted to favor aftermarket industry sales. However, while the fundamentals remain strong, automotive aftermarket consumers are now feeling more pain from higher prices and other macro-economic factors,” Shipley said. “Now is the time to reinforce the industry’s relationship with lower income buyers, by offering more cost-effective options while also maximizing the spending ability of higher income shoppers.”