While Halloween will rule U.S. store shelves and consumers’ attention for the next few weeks, retailers’ attention is already fixed on the upcoming holiday shopping season. Some of the lessons learned throughout the pandemic period will need to be cast aside, but other pandemic behavior shifts will remain in play. Keeping the focus on consumers and their spending priorities is a helpful way to successfully navigate the coming holiday season and beyond.

Reemergence Mindset

It’s not all doom and gloom in the retail world, as more U.S. consumers are going out in the world and spending again. We can anticipate more holiday parties and travel throughout the season this year, which means more spending on products for home entertaining and out-on-the-town apparel. Still, the specter of higher prices — and lower spending power — could dampen the celebratory mood.

“Retail sales most likely won’t hit high peaks this year because consumers’ budgets are a lot more stretched these days,” said Don Unser, president of general merchandise and retail thought leadership. “That’s why a longer holiday season is good news for retailers. Overall, holiday revenue might turn out to be similar to last year, but unit sales most likely won’t break any records.”

Average Price By Industry

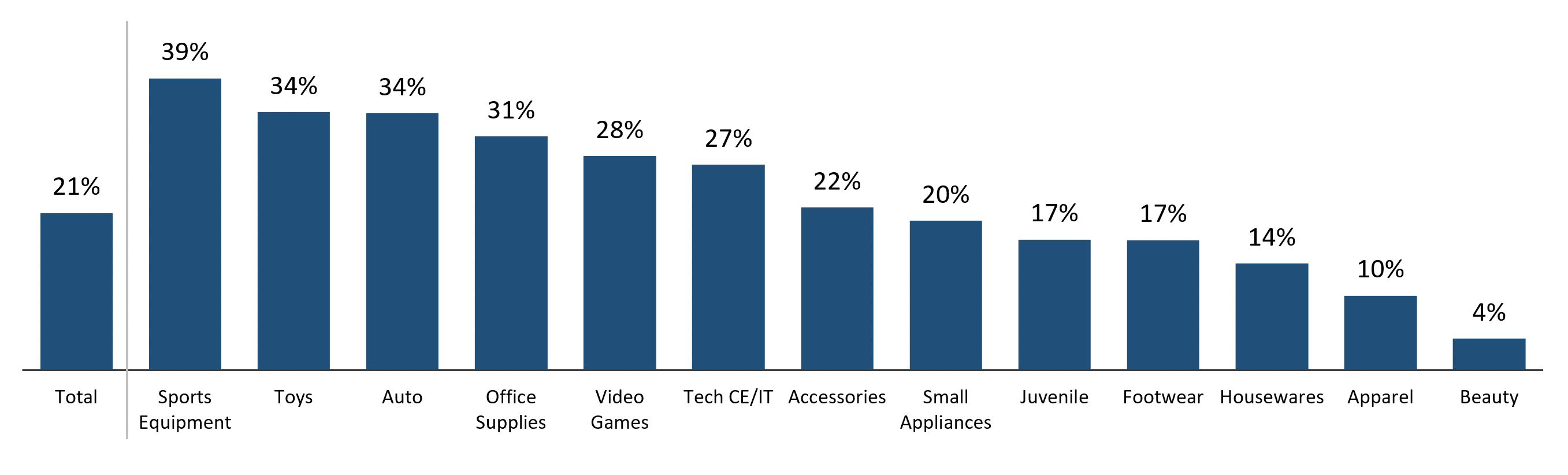

Increases in average price continue into 2022 compared to pre-pandemic.

Fewer Promotions|Higher Prices|Product Mix|Less Price Sensitivity|Product Innovation

Year-to-Date (Jan-Aug) 2022 Average Price % Change vs. 2019

Sorted by ASP % Change largest to smallest YTD 2022 vs. 2019

Source: The NPD Group/ Retail Early Indicator, NPD universe

Inflationary Pressures

As consumers emerge from their pandemic cocoons, they are also waking up to higher prices stemming from rising inflation. Although employment levels have remained strong across the U.S., shopper spending power is taking an ever-larger hit. Throughout the past year, consumer demand and spending have for the most part managed to maintain parity with pre-pandemic levels; however, with food costs edging higher, interest rates and the overall cost of living rising, and discretionary retail unit sales weakening, there may be a reckoning ahead. In fact, a recent NPD omnibus survey showed 78% of consumers expect to spend the same amount or less on holiday gifts this year compared to last year.

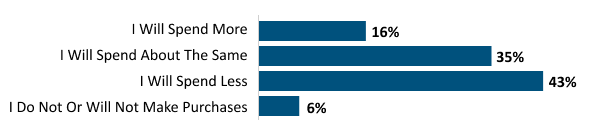

Will Inflation Impact the Holidays?

Despite higher prices, just over 50% of consumers plan to spend the same or more this holiday season. However, 43% are planning to spend less.

How will the higher prices impact your upcoming holiday purchasing compared to year ago?

Q. How will the higher prices impact your upcoming holiday purchasing compared to year ago? Base: Total Respondents 1,023

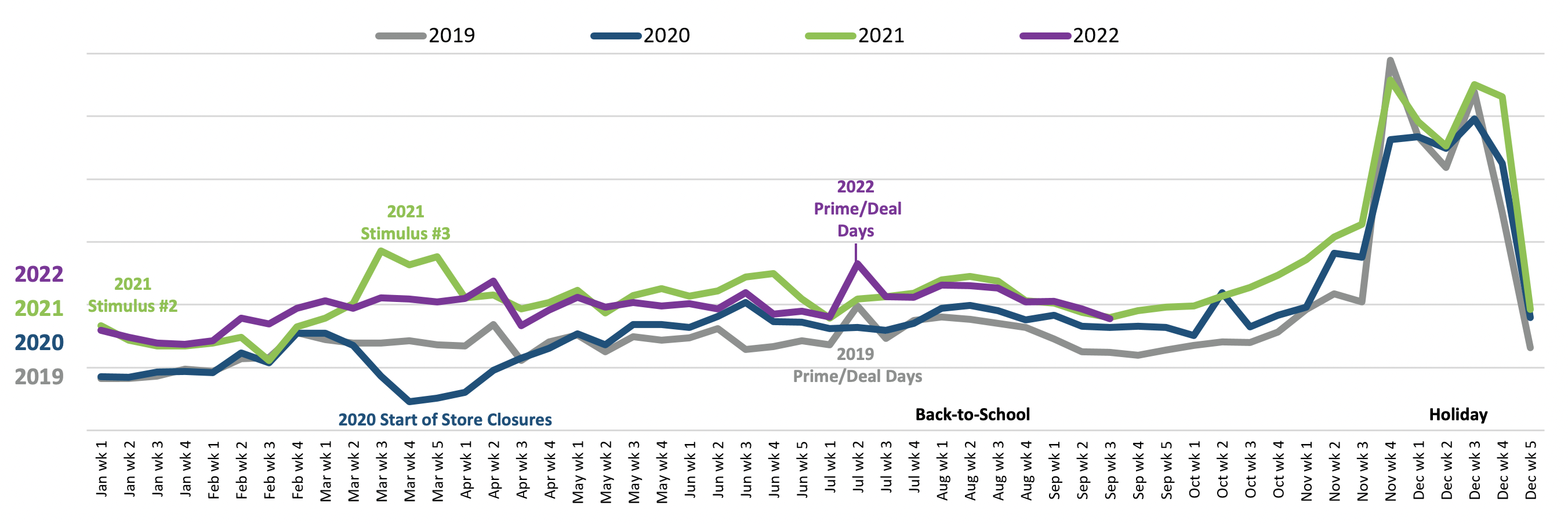

Elongated Shopping Seasons Continue

The back-to-school shopping season offers a preview of how consumers might respond this holiday shopping season. Given the consistent flattening of retail peaks during the holidays so far in 2022 (see Easter, Mother’s Day, Father’s Day, and Back-to-School), retailers and manufacturers should prepare for an even more elongated holiday season this year. Consumers will still spend, but retailers will need to find effective ways to get them to start making their lists and shopping for gifts even sooner.

“Holiday promotions from major retailers will start in earnest in October this year, which will start the countdown to Black Friday, Cyber Monday, and Christmas,” said Marshal Cohen, NPD’s chief retail industry advisor. “One lesson we’ve learned from these early holidays is that the effectiveness of promotions has shifted. Retailers are trying to create a sense of urgency to entice consumers, but it’s not resonating with shoppers the way it has in the past. Without that strong promotional enticement, people will continue to buy at times that suit them, rather than on retailers’ schedules.”

Dollar Trends: Year to Date

Weekly Dollar Volume Trend ($B)

Week Ending January 12, 2019 – through Week Ending September 17, 2022

Discretionary retail includes the following industries: accessories, apparel, auto parts, beauty, consumer technology, DVD/Blu-ray, footwear, housewares, juvenile products, office supplies, small appliances, sports equipment, toys, video games

Source: The NPD Group/Point-of-Sale First Read Data, limited release

Holiday Shopping Expectations

Retailers and manufacturers should prepare for an elongated holiday season with consumers shopping prudently to account for higher retail prices.

Compared to last year, 43% of respondents indicated they will spend less this holiday season due to higher prices.

Of respondents who feel their shopping will not be impacted much, nearly 50% indicatedthey will seek more sales compared to last year.

More than 50% of respondents who don’t see their shopping impacted due to higher prices are likely to start shopping early this season to get the products they want.

Expert Pre-holiday Roundup

Read on for early views of the upcoming holidays from NPD industry advisors …

Joe Derochowski

Vice President, Industry Advisor, Home and Home Improvement

Here’s the main takeaway for home product retailers looking ahead to the holidays: While gift giving is important, it’s not the only thing driving sales during the holidays. One big behavior change we’ve been tracking in home products is the return to indoor entertaining. Due to the pandemic, it’s been nearly three years since indoor holiday entertaining was big in the U.S. — even as recently as last year, the omicron variant made indoor entertaining a dicey proposition. But this year, people have gotten more comfortable bringing friends and family into their homes, so consumers will again invest in serveware, beverageware, and other home-entertaining standards.

There’s an added bonus for the holidays this year, with Prime Day and other large-scale promotional events from retailers scheduled again for mid-October. People who like to buy on promotion tend to start shopping early, which means Black Friday promotions could be adversely affected by these earlier promotions. Like last year, we can also expect lots of last-minute shopping, especially for high-quality products in the personal care category (e.g., massagers, electric toothbrushes, etc.). Although there might be fewer unit sales overall this year, higher prices mean sales revenue will most likely track similarly to, or even higher than, last year.

Juli Lennett

Vice President, Industry Advisor, Toys

All signs point to Amazon launching another Prime Day promotion in October this year — and other large retailers will no doubt launch their own early promotions. That means the holiday season would kick off earlier, in a more impactful way, than last year. The fact that Christmas Day falls on Sunday, one day later than last year, is another bonus for the toy industry. The last time that happened, the final holiday shopping week led to an increase of 28% in toy sales, which translated to almost a half-billion dollars in growth.

Retailers did not have enough inventory for the holidays last year, so there has been a lot of up-front buying this year. Retailers have already made their bets on the holidays and want to see the inventory flow out, and these October promotions help them do just that. Getting shoppers in early means there’s less pressure to promote in November and December, and a longer shopping runway could lead to more spending throughout the holiday season. In addition, our data tells us that consumers from lower-income households are more likely to be last-minute shoppers so, that, combined with Christmas Day moving to Sunday, means toys could still experience strong growth as late as the week before Christmas.

Kristen Classi-Zummo

Director, Industry Analyst

Spending on apparel this holiday season will shift to reflect what consumers truly want and need versus categories that are “nice to have.” In a recent poll, 78% of consumers reported they have cut back or plan to cut back on spending as a result of inflation. Over half (52%) cited apparel as an area where they will reduce their spending. This pullback on apparel was evident during this year’s back-to-school season. As of September, two-thirds of parents still had not purchased all their children’s back-to-school apparel and footwear items for the season. One-third had not bought because they simply did not need to, and 15% did not have the budget to spare. Kids have been getting away with wearing their summer clothes during the first warm weeks of school, as parents dedicated more of their back-to-school budget to supplies and other higher-priced necessities.

We anticipate seeing similar behavior during the upcoming holiday season. As prices rise on everything from decorations to dining, apparel categories that were heavily replenished last year, like active and basics, might be challenged during the holidays.

The exception to this pullback will be dresses, blazers, and other dressier categories. As gathering with friends, family, and colleagues will be at the top of to-do lists for the holidays, we expect the growth we’ve been seeing in “dressing up” categories to continue throughout the rest of the year. So far this year, categories have been less reliant on promotions, as non-promoted sales continue to grow. We’ve also noted higher growth in national brands compared to private label.

As prices continue to rise across the board, the apparel industry needs to be laser focused on what’s driving consumer demand during the upcoming season. Expect hot brands, new trends, and wardrobe needs (like going to events and a change in weather) to drive consumers to spend on apparel. For many categories, consumers are being clear and deliberate with their spending — either they want it and they’ll buy it, or they don’t and they won’t.

Larissa Jensen

Vice President, Industry Advisor, Beauty

When looking at unit performance across the 14 discretionary retail industries we track, only prestige beauty is posting growth. Part of the reason is that beauty has had one of the lowest average price increases, but another key factor is beauty consumers themselves. The majority of our shopper base is higher income, earning over $100K per year. This consumer segment has grown; plus, they are less likely to feel the pinch of inflationary pressures. In many ways, this dynamic has kept the prestige beauty industry somewhat insulated from negative economic headwinds this year.

Consumers continue to indulge in prestige beauty, particularly during retailer promotions, which are especially prominent in the fourth quarter. Beauty sales have traditionally clustered around the last few weeks of the holiday season, with categories that lend themselves to be more last-minute gifting options for many consumers. Fragrance, as an example, famously enjoys its biggest spike in holiday sales the week before Christmas, regardless of when holiday sales started. So an elongated holiday season might only serve to add incremental revenue into the industry. Due to the anticipated increase in promotion in the last quarter, and the consumer spending trend observed during promotional periods, we are optimistic the upcoming holiday season will be strong.

Looking ahead to 2023, while our industry remains somewhat insulated, at some point spending might slow down, as the consumer need to replenish or treat (which has been the hallmark of the past two years) leaves them with an overabundance of product.