As we head into the final quarter of 2022, B2B technology reseller demand in the U.S. has remained positive, up 15% year over year through August, totaling nearly $43 billion in sales. According to NPD’s Vertical Reseller Tracking Service data, 19 of the 20 NAICS sector verticals are seeing growth even in the wake of record inflation, lingering pandemic conditions, and a recovering supply chain. While the strength and resilience of the channel has been a welcome sight, economic conditions overall are expected to remain difficult until the supply and demand imbalance returns to a more predictable state. Inflation in many cases has been a biproduct of an overheated economy and the Federal Reserve is working to slow the economy down through a more contractionary policy, leveraging interest rate hikes to help slow investment and economic expansion.

With the Fed’s policy changes beginning to take effect, what are some things businesses can do to attempt to anticipate economic impact? How can they determine which sectors will likely feel the greatest impact and what will the potential impacts be on IT spending in 2023?

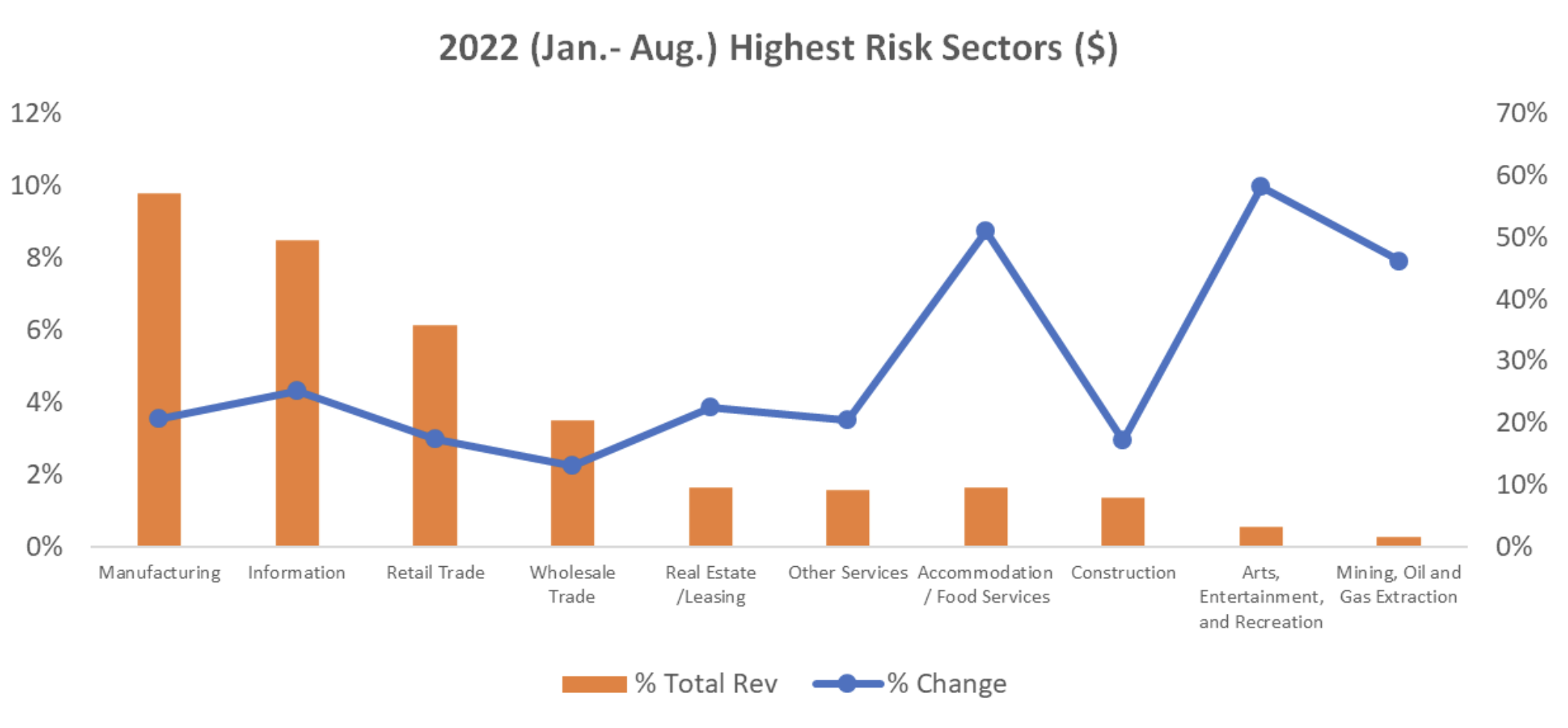

Leveraging NPD’s Vertical Reseller Tracking Service data, sector mapping provides the ability to identify sector performance and based on reliance of consumer discretionary spend and other factors, can help identify which sectors will likely be more negatively impacted during a recession. Based on this analysis, 11 of the 20 sectors fell within the highest risk classification. Through August 2022, these sectors represented the highest growth percentage, up 22% vs. year ago; however, represented only 35% of total revenue in the channel. Much of the accelerated growth was seen in sectors affected by pandemic conditions receding and consumers returning to travel, restaurants, as well as sports and other venues.

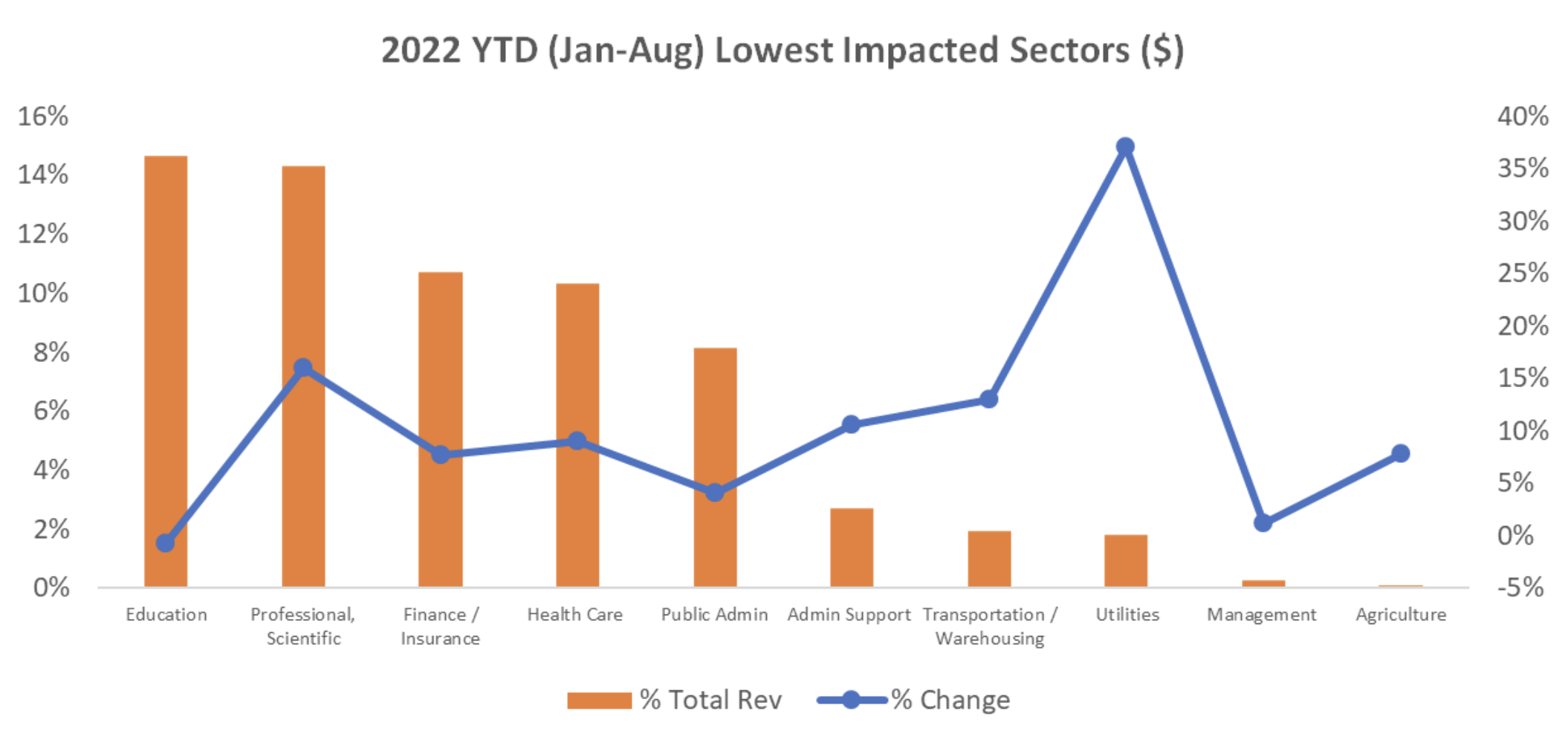

Looking at the sectors that felt the least impact, combined growth reflected a more modest 8% revenue gain vs. year ago through August, however revenue contribution was significantly higher at more than 65% of total revenue year to date. Sectors in this set include critical services such as healthcare, utilities, and public administration, which all fare better during poor economic times as they are significantly less reliant on consumer discretionary spend.

As we round out 2022 and embark on the new year, we expect there will be continued economic pressure as inflation will likely remain elevated through the majority of the year, with the Federal Reserve continuing tactics to help slow the economy. Expectations from a B2B technology perspective are that in the event of a recession, IT spend will see momentum slow in midsize and enterprise organizations as projects will likely be more closely scrutinized as higher interest rates will impact overall company performance and the ability/willingness to expand. Based on NPD’s Future of B2B Technology forecast, we expect to see overall unit sales increase 7% in 2023 vs. 2022, as a result of declining average sales prices. This will lead to a slight revenue decline of 1% vs. 2022. While 2023 still has a fair share of unknowns and potential challenges, the resiliency of the channel is expected to drive a return to revenue growth in 2024.

Get insights straight to your inbox