Home > Insights > Press Releases > Growth Streak Continues for the US Beauty Industry in 2023, Circana Reports

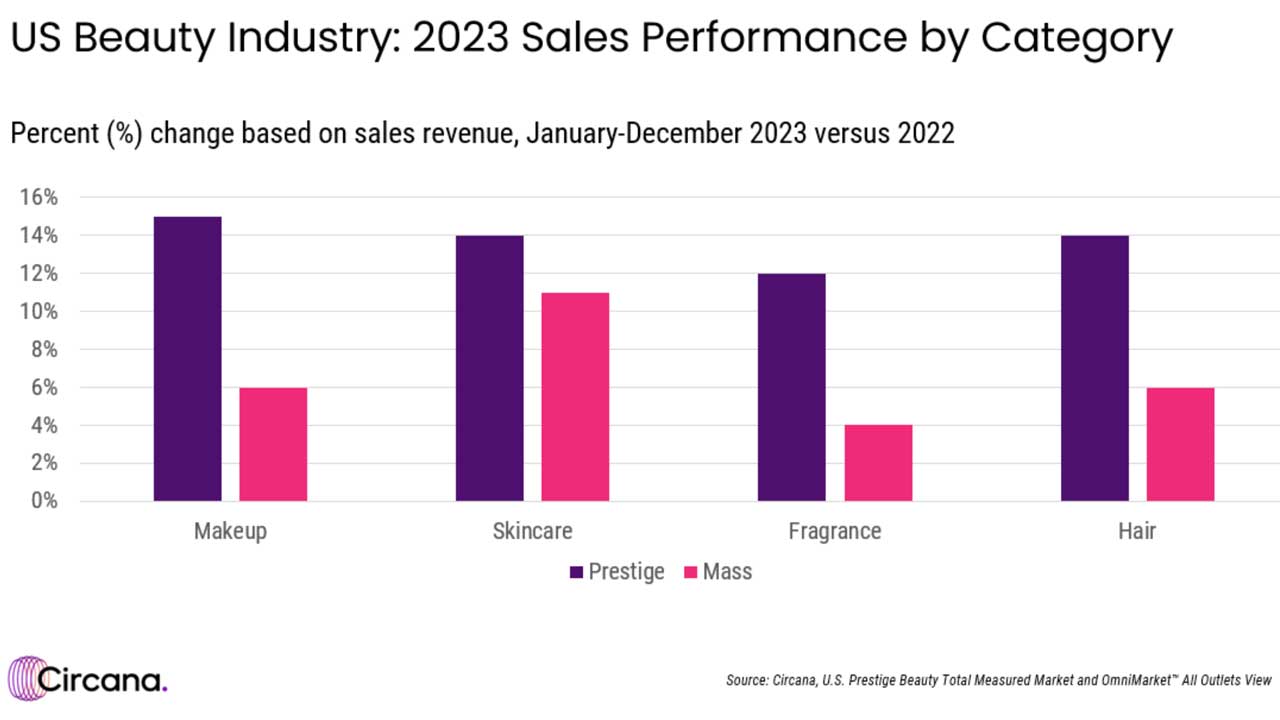

CHICAGO, January 30, 2024 – U.S. prestige beauty industry dollar sales grew by 14%, year over year, to reach $31.7 billion in 2023, according to Circana, a leading advisor on the complexity of consumer behavior. In comparison, mass market beauty sales experienced a year-over-year dollar increase of 6%.

In the prestige channel, which includes U.S. department and beauty specialty retailers, makeup was the fastest-growing category based on dollar sales, while skincare captured the top spot as the fastest-growing category based on units sold. In the mass market, makeup and skincare were the only two categories to grow based on units sold.

Within prestige makeup, lip makeup was the strongest performer, growing at twice the rate of the overall category, up 31%, led primarily by products such as tinted lip oils and balms. Looking at prestige skincare trends, face serums and creams, body sprays, body lotions and creams, and body cleansers were among the top performers in the category. Circana’s receipt-based Checkout data uncovered some interesting demographic buying behaviors that coincide with teens’ and tweens’ rising interest in prestige skincare: Gaining market share are 45-54-year-olds with a household size of four that includes children under 18 years old.

Prestige fragrance sales also concluded the year on a high note. Looking at product trends, growth is happening on opposite ends of the spectrum: Higher fragrance concentrations including eau de parfums and parfums, which are also higher priced, gained three share points in 2023. On the other hand, lower-priced products, including mini/travel sizes and body sprays, gained traction. Unit sales for mini women’s fragrances grew at five times the rate of other sizes, and the size of the body spray market nearly tripled since 2022. The mini trend also manifested itself in gift sets, which was the fastest-growing segment of the fragrance market in 2023.

Across prestige hair products, hair styling was the fastest grower, with dollar sales up 24%. This growth was to a large degree powered by innovation: Hair launch volume more than doubled versus 2022. Hair was also the only beauty category to capture more of its sales online, with e-commerce accounting for 52% of the volume.

“The beauty industry is strong and the outlook remains positive for both the mass and prestige sides of the business in 2024,” said Larissa Jensen, global beauty industry advisor at Circana. “This performance is remarkable given the phenomenal growth it has experienced for the past two years, but the industry should not rest on its laurels. Consumers continue to cope with economic pressures, and being in tune with their shifting mindset is a must. Flexibility, creative thinking, and effectively harnessing high consumer engagement are all part of the winning formula to drive continued growth.”

marissa.guyduy@circana.com

Manager, Public Relations

Circana (formerly IRI and NPD)