The holiday season is traditionally a time of good cheer and brisk spending. This year the usual seasonal cheer is tempered by higher prices and fears of inflation taking an even bigger bite out of shoppers’ budgets. After two years of strong holiday sales, retailers can expect smaller gains this year. Consumers are prioritizing the basics and spending less on non-essential general merchandise — in this environment, promotions are a handy lever retailers can pull to entice shoppers to spend, which will reduce inventory during and after the holidays.

Inflation Causes Consumer Pullback

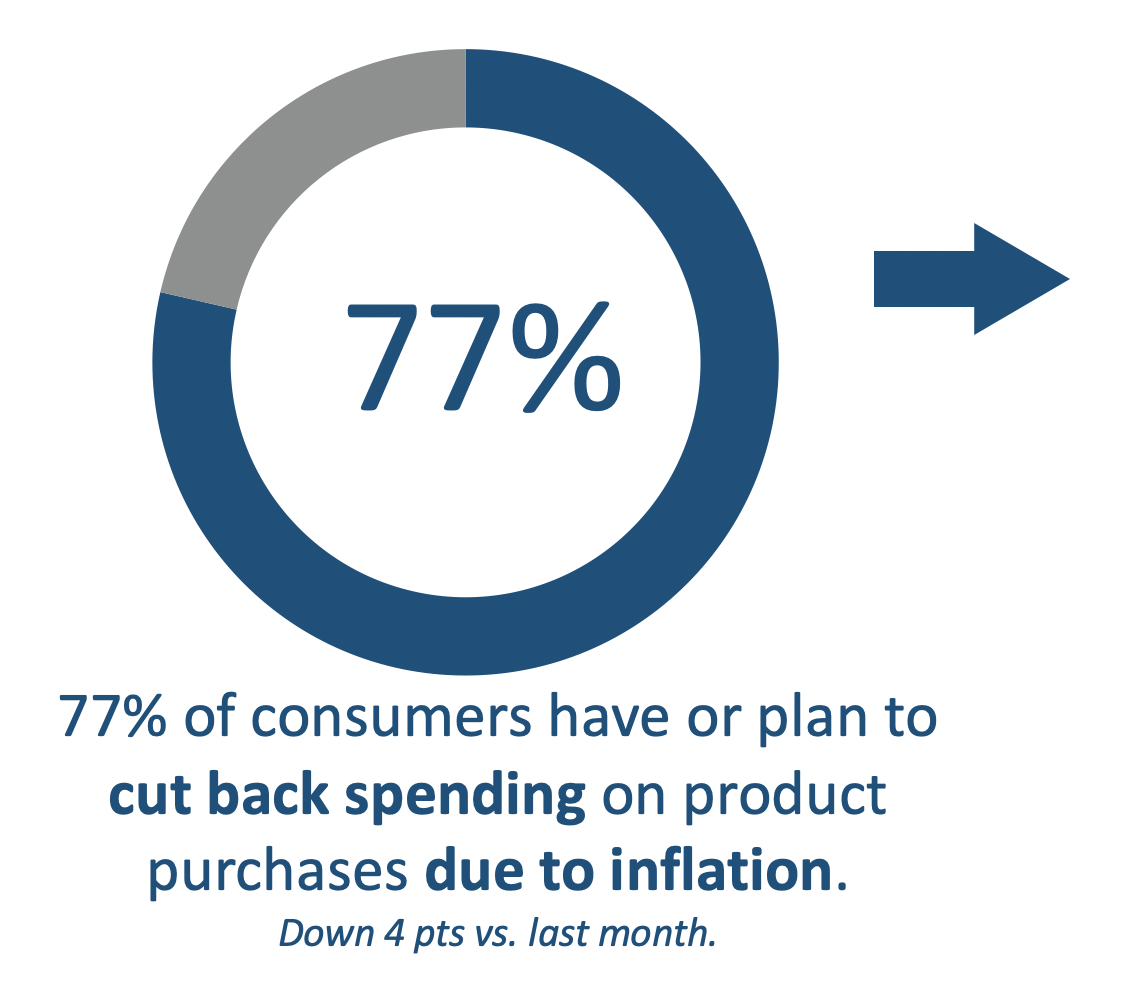

77% of consumers stated they have or plan to cut back spending because of inflation, down 4 points compared to the prior month. Restaurant dining remained the top category for reduced spending but consumers are easing up on their cutbacks in this area.

Q. Due to inflation, have you or do you plan to cut back your overall spending on

product purchases? Base: Total Respondents 1056

Q: On which of the following types of products/services have or do you plan to cut

back spending? Base: Plan to cut back on overall spending due to inflation 812

Source: The NPD Group/Omnibus Survey October 2022

“Although sales revenue performance remains on par with 2021, the continuing unit-sales deficit compared to previous years highlights the inflationary reality that consumers have less spending power than they did in the past,” said Marshal Cohen, chief retail industry advisor for NPD. “However, as the cost of living continues to rise, consumers will continue to spend. They just need the right enticements. And, when done right and at the right time, promotions are proven to help consumers to open their wallets and spend.”

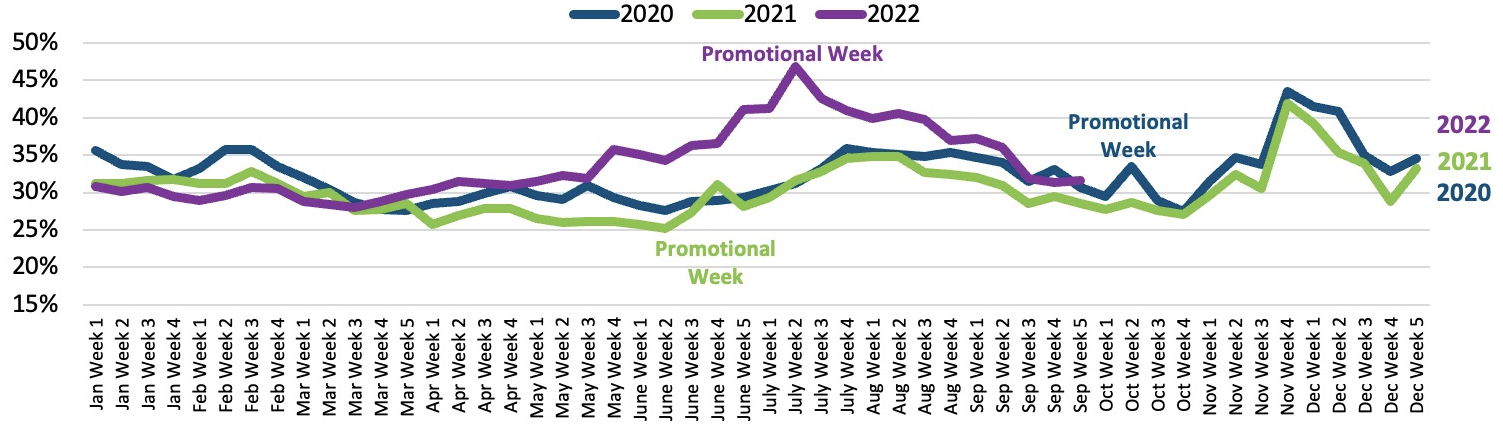

Throughout 2022, as prices for food and general merchandise have continued to increase, the amount of promotional activity has also grown. In fact, in the third quarter, about 40% of general merchandise units were on promotion, which is 7 percentage points higher than during the same quarter in 2021.

More Promotions With Less Lift

In Q3 2022, about 40% of units were on promotion, increasing 7 percentage points compared to last year.

General Merchandise Weekly Percent of Units on Promotion: 2020, 2021, YTD 2022

Includes Accessories, Apparel, Auto Parts, Auto Tires, Beauty, Footwear, Housewares

Juvenile, Office Supplies, Outdoor/Team Sports EQ, Small Appliances, Tech, Toys

Source: The NPD Group/Price and Discount Trends

Retailers and manufacturers need to be wary of promoting too frequently, which can dull the power of promotions. In the third quarter of 2022, all general merchandise industries tracked by NPD increased the number of units on promotion. The apparel industry posted one of the largest increases — more than half (53%) of apparel was sold on promotion, up 10% compared to the third quarter of 2021. Footwear on promotion has risen 12% in the third quarter, versus the third quarter of 2021.

“Even with more items available during promotional periods, there has also been a decidedly softer week-over-week sales lift from those promotions,” Cohen said. “The 2022 lift heading into mid-October promotional events fell short of the October lift of 2020, which is likely due to the presence of other sales earlier in October.”

The week-over-week lift heading into October’s promotional events did not match October 2020’s lift, likely due to the presence of sales earlier in October.

Dollar Volume and Week-over-week Percent Change

Source: The NPD Group/Point-of-Sale First Read Data/Limited Release

Looking Ahead to the New Year

As always, promotions continue to be important for retailers trying to keep shoppers spending throughout the holiday season. And in 2023, promotions will be even more crucial, as retailers and brands look for ways to slim down inventory gluts and respond to consumers’ annual holiday shopping hangover.

“Holiday sales numbers got off to weak start, so retailers hit hard on promotions in October to push more spending,” said Don Unser, president of thought leadership for general merchandise and retail for NPD. “But these promotions aren’t discounting more in value; they are just increasing the frequency, which results in lower comparative lift. Add to that the runaway train of rising food prices, and it’s clear retailers have a heavier lift this year and into next year, when it comes to making decisions about promotional depth and timing.”

Vertical Industries in Focus: The True Meaning of Promotions

Larissa Jensen

Vice President, Industry Advisor, Beauty

The share of units sold on promotion in the U.S. beauty industry represents about one-quarter of units sold. That share has declined over the past two years, not only versus 2020, but also compared to 2019 (before the pandemic). Despite the reduction of units on promotion, the beauty industry continues to post growth in both revenue and units across all categories as consumers trade up through their product and brand choices. For example, growth in both fragrances and hair care has been propelled by premiumization that is happening in each category, with consumers opting for higher-priced items and luxury offerings.

Retailer promotions in particular tend to cause sales spikes throughout the year because consumers have been trained to wait for deals. Even so, we continue to observe consumers shifting to a “treat mindset,” leading to stronger growth in non-promoted products across certain beauty categories, like fragrance.

Looking ahead to 2023, the beauty industry might be at risk for an increase in promotional levels if consumers find they have an overabundance of products after treating themselves to little luxuries in beauty over the past few years.

Beth Goldstein

Executive Director, Industry Analyst, Fashion Footwear and Accessories

Footwear is among the most promotional general merchandise industries, in large part due to the high level of fragmentation and competition among brands and retailers. In 2019, prior to the pandemic, 43% of units were sold on promotion through the third quarter. In 2021, with low inventory and high demand as consumers emerged from the pandemic, this percentage dropped to 37%. In 2022, before even hitting the holiday season, it was back up to just above pre-pandemic levels, as the inventory scale tipped the other way and demand slowed. And while the fashion category has been a sales-growth bright spot in 2022 as consumers returned to in-person work, socializing, and other pre-pandemic activities, demand has also been propelled by promotions. The share of units sold on promotion in the third quarter this year was 16 points higher than it was last year. Performance footwear saw the smallest increase.

It seems the lower level of promotional activity in 2021 was unsustainable. We’ve seen increased promotion levels each quarter this year. We expect that to continue throughout the holiday season and into 2023, until there’s improvement in the macroeconomic conditions impacting consumers. This discounting will offset the base-price increases that have affected most of the major footwear categories, ultimately flattening out the average selling price, which has been growing for the better part of two years.

Maria Rugolo

Director, Industry Analyst

It’s no secret that higher prices are affecting how and what consumers are buying. In fact, nearly 80% of U.S. consumers recently told NPD they plan to cut back their total spending due to inflation. The category they expected to spend less on, after food, was apparel. While this is unwelcome news for apparel manufacturers and retailers, it does make sense since many consumersinvested heavily in this category in 2021.

Retailers must be cognizant of consumer spending changes caused by rising prices. NPD’s Checkout Omnichannel Tracking data reveals the amount consumers spend is growing, but shopping frequency is declining. With fewer shopping trips, retailers must find ways to capture shoppers’ attention while they are in stores and, in some cases, play up one-stop-shopping.

One tried-and-true attention-grabber is promotions. But not all categories exist on the same promotional playing field. Some need-based categories perform better at full price, while other “nice-to-have” categories must rely more heavily on promotion. In the third quarter of 2022, over half of apparel units sold were promoted — a 10-point increase over last year, even though total unit sales fell 6%. The only unit growth came from promoted products, which rose 17%. Unit sales of products that were not promoted fell 20%. As retailers look to realign inventory, higher pricing, coupled with more promotions, has helped to keep sales revenue afloat, even as unit sales decline.

These days, companies must quickly align with the areas where their customers are spending. For example, when weddings came back, party dresses and more formal attire were in demand and not as heavily discounted. There are many areas like this where we can see quick shifts and fluctuation. And because spending is in flux, companies will need to continue to pivot quickly, and promote effectively, to meet shoppers’ changing needs.

Dirk Sorenson

Executive Director, Industry Analyst

The sports equipment business is currently wrestling with how to address inventory challenges caused by the recent reduction in consumer demand. And suppliers and retailers are turning to promotions to address this challenge.

Golf provides a good example of how the sports industry is using promotions to handle oversupply. Golf balls are often used by retailers to generate traffic and they experienced a low single digit unit-sales increase after being promoted in the second quarter of 2022; however, promoted prices were almost 15% higher than they were the prior year in the second quarter. Why? Because retailers were less concerned about using broad promotion to generate retail traffic and more concerned with drawing down inventory.

The golf club category, on the other hand, had a larger share of promoted units while promoted prices increased slightly. This all occurred in the second quarter, as golf club sales declined in low single digits. Retailers were trying to create demand across the entire golf club category, not just a limited subset of items. The lack of deep discounts for clubs was influenced by costs for such equipment increasing. This was a common trend for many sports hard goods.

These divergent trends for sports equipment are evident across all retail channels. As retailers and manufacturers continue to manage reductions in demand with associated price increases, many sports equipment sales trends and promotions trends will resemble the golf club promotions seen in the second quarter. Very little promotion to generate traffic will occur.

Kristen McLean

Executive Director, Industry Analyst

In the U.S. book market, we expect 2022 holiday sales to slip back toward pre-pandemic timing with economic concerns causing a bit of a drag on shopping. That means a later start than last year, and stronger volume for hotly anticipated titles in autobiography, pop-culture, lifestyle, and cooking. Black Friday and Cyber Monday promotions are less of a factor when it comes to books, but holiday volumes definitely ramp up the week after Thanksgiving. While 2022 will fall short of 2021’s heady heights, we expect the volume to still come in over pre-pandemic levels by the time we finish the holiday.

Cover prices have already gone up on new books this year; so far, promotions have been limited to price-matching among the biggest retailers on very specific titles. Overall stock levels are good this year, so we think there will be plenty of book buying, especially in children’s categories where books are seen as an affordable, high-value gift.

Juli Lennett

Vice President, Industry Advisor, Toys

The retail situation with toys is the opposite of last year. There is more than enough toy inventory in the channel, which will spark higher promotional levels and likely deeper discounting.

With inflation and other macroeconomic factors working against consumers — which could move toy purchases to later in the season — we can anticipate much stronger promotional levels and deeper discounts this year compared to last year. We’ll also see a stronger shift from the online channel to in-store, where average selling prices are lower. It will be challenging to grow during these two weeks.

Paul Gagnon

Vice President, Industry Advisor, Consumer Technology

Early-season tech sales have been slow, which is a bit surprising given the trend of the last few years to drive early demand and, for some key retailers, to launch early October promotions. This could indicate consumers are waiting for traditional deeper discounts on Black Friday and Cyber Monday this year. Therefore, sales could grow against the softer Black Friday performance last year.

Discounts have been modest so far this holiday season, but electronics product costs have been marching steadily lower, along with lower logistics costs and better availability. There is still room for good promotions over the holidays, especially as the season winds on and if inventory pressures build due to a slow start.

TVs are a frequent headline product for Black Friday promotions and drive a significant amount of tech revenue each holiday season. This year will be no different. Prices have been, and will continue to be, much lower than they were a year ago; there is plenty of inventory and assortment to choose from.

Purchase interest is high for mobile products as consumers get back on the road to visit friends and family this holiday season. Expect plenty of promotions and discounts on products aimed to make travel more enjoyable, like smartphones, wireless headphones, and tablets.