Fundamental Spending Shift: Black and Hispanic Consumers

One example of a recent fundamental shift in consumer spending centers on ethnicity: Hispanic or Latino and Black or African American consumers have increasingly contributed to growth in general merchandise sales since before the pandemic. However, their spending activity slowed during the 2022 Holiday period.

Black & Hispanic Consumer Spend Elevated to 2019

Compared to 2019, Black and Hispanic consumers outpaced in dollars and units compared all other ethnicities.

*Consumers self-identify their ethnicity in Circana’s Checkout data.

“This is just one example of trends shifting relatively rapidly. Retailers and brands cannot rely on what happened last year to repeat this year,” said Don Unser, president of general merchandise and retail thought leadership at Circana. “Marketers need to plan for consumer volatility, closely monitor changes to areas of growth, and work harder to engage consumers through the ups and downs ahead.”

Older Consumers Lead Sales

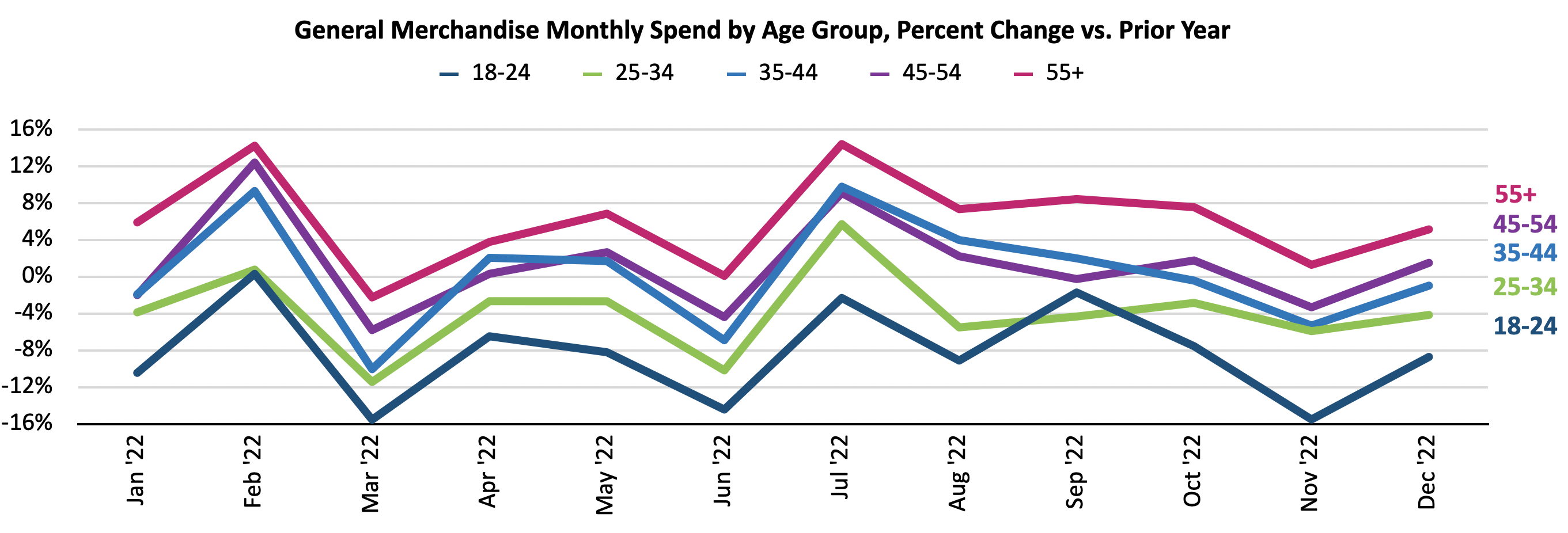

With all the attention focused lately on Millennials and Gen Z, we may forget Gen X and Boomers. Retail consumers age 55 and older came a long way and have learned a lot since before the pandemic. Not only have they become more comfortable shopping online, but they also account for the most U.S. retail spending growth. Older consumers wield the most generational spending power. They are more likely to have amassed higher levels of income and savings over the years, and many senior citizens also received a big raise in social security benefits this year.

55+ Consumers Drive General Merchandise

In 2022, 55+ consumer dollars grew 5% compared to last year, while all other ages combined declined -2%.

Source: Circana, Checkout, 2023.

“If you’re a retailer who is not taking into account the multiple dimensions of age segments, you’re missing out,” said Marshal Cohen, chief retail industry advisor for Circana. “Sure, certain products might not seem like they would interest mature consumers, but many will. Even video games have extremely high levels of interaction with older age groups these days.”

Consumer Income Levels and CPG and General Merchandise Sales

The chart below graphically illustrates how inflation relates to wage growth in the U.S., by income level. The greatest wage growth in the past two years accrued to the lowest wage quartile, which includes hourly wage earners, social security recipients, and other lower-income and fixed-income consumers. Throughout 2022, the highest growth potential was among the two lowest-income quartiles. In fact, low-income earners were the only wage group to keep up with inflation last year due, in part, to federal stimulus payments during the pandemic. Their spending power also rose. Higher-income earners, comparatively, had the lowest spending-power gain.

CPG Prices Outpace Nominal Wage Growth

In December, all wage quartiles grew at the same pace or faster than discretionary average prices, except for top earners. CPG ASPs continued to outpace.

Wage quartiles 1 – 4, lowest to highest

Source: Circana, Retail Early Indicator, Circana universe and Circana Total Market View MULOC – F&B and non-edible CPG, 2023.

Source: Bureau of Labor Statistics Current Population Survey and Federal Reserve Bank of Atlanta calculations, Moody’s Analytics, 2023.

“It’s important to look carefully outside your business to see all the various factors that could affect sales,” Cohen said. “Retailers and brands selling in general merchandise retail and CPG categories also need to keep an eye on what’s happening with the prices of food and fuel vis-à-vis wage elevation, to see how it impacts your business. An important key to retail success is identifying where the spending power exists and responding accordingly.”

Read on to learn the role demographics play in these specific general merchandise retail categories.

Footwear: Households with children set the sales story

Beth Goldstein, Industry Analyst

In terms of the consumer segments that are driving or dragging the footwear market, it’s not a simple demographic story based on income or age. The consistent factor is whether the household has children under age 18. Those that do are underperforming their child-free counterparts, across age groups and income ranges.

Key takeaways:

- Millennials without kids in the household generated 13% of the footwear sales in the 12 months ending February 2023 but accounted for 44% of the growth in the market, versus the prior year. Millennials with kids represented about a quarter of the declines. Gen Z households with kids generated half of the declines.

- However, these families are not spending less on kids’ footwear. They are pulling back on adult footwear, which suggests that without the government assistance that many households with children had received, they are now prioritizing their kids’ replacement needs over footwear purchases for themselves.

- Messaging around value for the family will be important as these consumers are feeling the pinch due to increased prices on many of the necessities that they need to buy for their households.

Beauty’s myriad demographic opportunities

Larissa Jensen, Industry Advisor

The higher income consumer, with household earnings of $100K and higher, has been a pivotal source of growth for the prestige beauty market. However, key demographics can vary by beauty category and market in prestige fragrances.

These pockets of growth point to a myriad of demographic opportunities across the beauty landscape:

- In prestige fragrance, the demographics growing in importance across key market drivers (like stronger fragrance concentrations) include younger Hispanic and Black consumers with household incomes under $45,000 per year.

- In the mass market, growing demographics for total beauty include younger, middle-income Asian consumers.

Video gamers’ average age is on the rise

Mat Piscatella, Industry Analyst

The age of the average video game player in the U.S. is rising. Those aged 45 and older represent the fastest growing segment in video game audience size, as many were either introduced or reintroduced to video games over the course of the pandemic. This audience joins those who grew up playing PC video games or early consoles, like the Atari 2600 (and never stopped), are now entering the 45-and-older demographic. With three out of every four consumers in the U.S. engaging with video games, it is truly a mass-market entertainment medium.

Key takeaways:

- Video gaming appeals to audiences across demographic groups, with tremendous marketing and cross-promotional opportunities for brands that may not have before considered video gaming as part of their portfolios in the past.

- Expanding product and service offerings to engage this dynamic and evolving audience may offer significant opportunity beyond the stereotypical gamer target.

Consumer technology shored up by higher income buyers

The latest Future of Technology forecast reports consumer technology sales will decline by an additional 3% year over year in 2023 and remain flat in 2024. Even though higher income households are responsible for a greater share of overall spending and spending growth, replacement cycles are long for tech products. We are feeling that slowdown now; however, the upgrade cycle will come around again, and tech sales are expected to return to growth in 2025.

Key takeaways:

- According to Circana’s Checkout data, tech spending by 18-to-24-year-olds declined by 19%, year over year in 2022. By comparison, spending by 35-to-44-year-olds fell just 8 percent and 55-and-older spending was flat.

- Most consumers invested in tech over the last three years and are not looking to upgrade … yet.

- When budgets get tight due to inflation, lower income and younger households feel the pinch the most due to lower levels of saving.