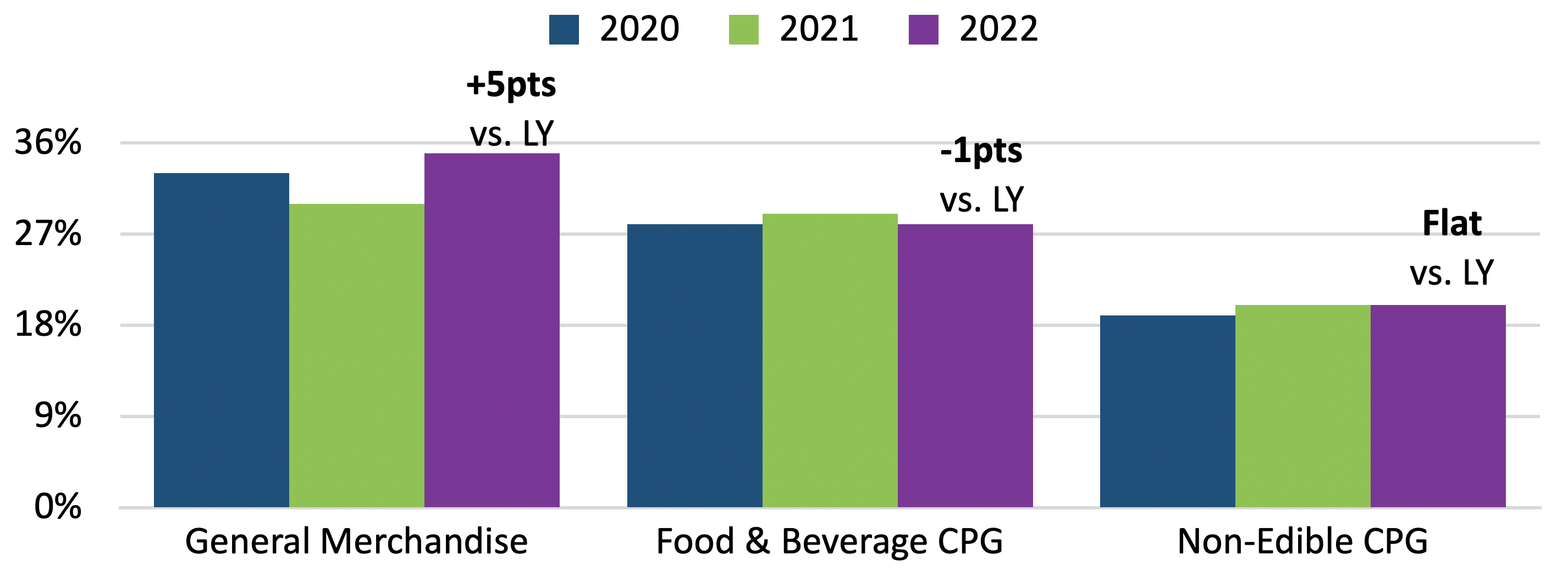

Food prices have impeded normal general merchandise purchase behavior, from both a consumer and retailer perspective. Widening the view to include consumer packaged goods (CPG) trends provides an even more comprehensive picture of the consumer. General merchandise, the area with the greatest demand challenges, enlisted the largest increase in promotional activity in 2022. Non-edible CPG promotion remained steady with 2021. The food and beverage segment had a lower promotional level than in the previous year.

Annual Share of Units on Promotion

Source: The NPD Group/Price and Discount Trends and IRi Total Market View MULOC – F&B/Non-Edible CPG (week ends on a Sunday)

“Despite the increase in promotional activity, general merchandise categories still face demand challenges,” said Marshal Cohen, chief retail industry advisor for NPD. “Consumers have conditioned themselves to buy what they need when they need it, rather than when they see value. This behavioral shift has made promotions less impactful than in years past.”

“The changing environment for promotions reveals the need for marketers to look outside their own businesses,” said Don Unser, president of general merchandise and retail thought leadership at NPD. “That could be the key to more effectively planning the timing, frequency, and depth of promotion necessary for success in the year ahead.”

Retailers and manufacturers are wise to consider the new landscape when assessing promotions’ value to their business. Read on to learn how some of our industry experts perceive the road ahead.

Apparel consumers shop cautiously and strategically

Maria Rugolo, Industry Analyst

As apparel average selling price (ASP) rose 8% in 2022, U.S. consumers spent more, but bought less. They continue to be strategic with their purchases, which increasingly has become the case with apparel. This puts pressure on retailers to offer the right mix of products, promotions, and inventory levels. It also means not losing sight of where innovation is needed in order to keep consumers spending, regardless of current economic conditions.

Key takeaways:

- Given that nearly 80% of U.S. consumers buy their apparel items when they need them, aligning to where they are spending is critical — or risk being put on the back burner (again).

- Appealing to consumers’ hybrid work, play, and fun lifestyle and where they are currently spending (e.g., travel) will capture their attention and spending.

Foodservice relies on promotional deals to grow QSR traffic

David Portalatin, Industry Advisor

Most promotional activity in U.S. restaurants occurs in quick service restaurants (QSRs). Inflation has allowed QSR operators to post strong sales revenue gains. However, as disinflation sets in, operators are beginning to look for ways to grow traffic. Promotional pricing will be a key lever.

Key takeaways:

- Deal traffic at QSRs in the fourth quarter of 2022 was up 4%. Non-deal occasion traffic fell by 1%.

- Digital discount offers from operators are hitting the mark with consumers, driving deal traffic growth.

- Traditional low-price-point value menu items experienced traffic declines during the fourth quarter.

Mobile device subsidies accelerate replacement

U.S. mobile carriers’ fierce battle to lure customers away from rivals has immensely aided the smartphone sector. Carriers’ aggressive attractive device subsidies, in the form of unrealistically high trade-in values for older smartphones, have led to users upgrading to new devices, which accelerates replacement cycles. This subsidy game is coming to an end. Carriers find themselves in financial gridlock due to rising interest rates and, more importantly, rising service revenue pressures driven by emerging players, such as cable operators branching into the wireless arena.

Key takeaways:

- Over the past two years, to reduce churn, most mobile carriers extended to their existing customers the device promotions designed for new customers. Since then, the ultimate winners have been consumers who received more money for their old devices and device makers that enjoyed an artificially inflated upgrade demand.

- Inventory challenges late last year gave carriers the excuse to pull back on subsidies. They have since shifted their focus to a bring-your-own-device (BYOD) model. The increase in the awareness and adoption of unlocked smartphones further facilitates this BYOD theme, which will put additional volume pressures on smartphone makers.

- U.S. mobile carriers have been on a mission to quickly migrate their customers from 4G to 5G networks. As 5G device adoption gradually increases, mobile carriers’ subsidy motivation will decrease, and consumers will end up paying more for their device replacements.

- Larger cable MVNOs in the U.S. have poached millions of subscribers away from the top mobile carriers. They continue to march forward with aggressive cable and mobile bundle offers. These offers have ignited new pricing wars that will lead to revenue pressure — andless ammunition to spend on device subsidy promotions.

Consumer technology: lackluster promotions weaken demand

Total U.S. consumer tech sales were weak during the 2023 holiday season, falling 9% in units and 11% in dollars. Promotions are critical during the holidays, and there was some added urgency in 2022 to avoid carrying over excess inventory resulting from weak demand during much of the year. However, while there were more units sold on promotion during the holiday season than in the previous year, the depth of those discounts wasn’t much different overall, and this appears to have negatively impacted demand. For some categories, like PCs, no amount of discounting or promotion helped demand due to a surge in purchases in 2020 and 2021.

Key takeaways:

- The share of consumer tech units promoted increased by 4 points year over year in the fourth quarter of 2022.

- The average promoted discount was unchanged compared to the prior holiday season.

- TV promotions were down 10 percentage points over the holidays in 2021, but the discount depth was unchanged. However, a 19% overall drop in average selling prices (ASPs) helped drive a modest 8% increase in unit sales. That was not enough to offset the much lower pricing and led to a 12% decline in sales revenue.

- Despite a 15-percentage point increase in promoted units (from 51% to 66%) and a 2% increase in promoted discount, unit sales of notebook computers fell 18% year over year. Notebook computers were the second-largest tech category during the holiday season.

CPG promotions well below historical levels

Alastair Steel, Client Engagement, IRI

Food and beverage promotions have been increasing steadily over the past year and getting closer to historical pre-pandemic levels. On the non-edible CPG side, we have also seen promotions pick up over the past four months, but they still remain lower than in the past. We expected a lot of deal-seeking behavior, given high inflation. However, consumers’ promotional lifts have not been recovering and remain 25% below historical levels. This may be due to the following two factors:

- With consumers being stretched they have less ability to stock up when their favorite products are promoted.

- With prices increasing more than 20% over the past two years, promoted price points do not seem like a good deal; ti takes shoppers a while to recalibrate what constitutes a “good deal” price.

Footwear’s increased promotional activity continues

Beth Goldstein, Industry Analyst

Footwear promotional activity gradually increased throughout 2022 as inventories grew and demand softened due to macro pressures, but this only partially offset the impact of rising base retail prices, leading to a 7% increase in average selling price (ASP) for the year. The heightened promotional activity will continue into 2023, and as manufacturer price increases level out, ASP changes will flatten.

- The share of footwear units sold on promotion reached almost 50% in Q4 2022, in line with 2019, according to NPD Price/Discount Trends.

- More than half (56%) of consumers reported delaying a purchase or choosing a less expensive footwear option in the past six months due to price increases on footwear and other good (Future of Footwear report, January 2023).

- Social media is a growing influence on footwear purchasing decisions, driving demand and keeping promotional activity low for the hottest items (Future of Footwear report).