Home > Insights > Press Releases > Consumers Plan to Do More Holiday Shopping In Stores Than Online, Reports NPD

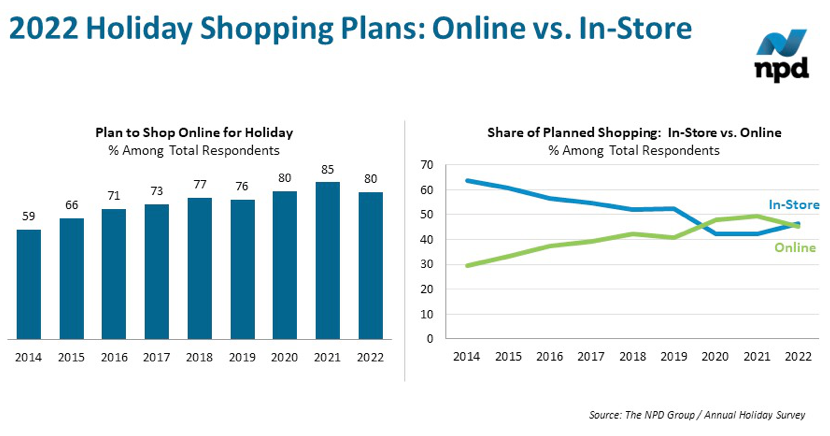

Port Washington, N.Y., November 9, 2022 – The number of consumers planning to shop online for the holidays fell from 85% last year to 80% this year, which is the largest ever shift favoring stores, according to the annual holiday purchase intentions survey from The NPD Group. This is also the first year, since before the pandemic, that consumers expect to make more of their holiday purchases in stores (46%) than online (45%). Checkout receipt-based insights from NPD also support these new findings, as in-store sales revenue grew 1% in September compared to last year, while online sales were flat.

“After more than two years of heavy online shopping, consumers are ready to get back to the sport of shopping,” said Marshal Cohen, chief retail industry advisor for NPD. “Despite saying they plan on scaling back holiday spending this year, sales revenue through October fell 1% below last year’s levels, which shows that shoppers are still willing to spend money on general merchandise, even as prices continue to rise.”

Nearly 80% of consumers still plan to do at least some of their holiday shopping online, but plans to shop pureplay e-commerce retailers declined since last year. Fewer than three-quarters of consumers expect to shop online-only sites during the holidays, down from 79% last year. Among those planning to shop online, 16% anticipate picking up their purchases in stores or curbside, compared to 14% last year, which will increase foot-traffic at brick-and-mortar stores.

Perhaps due to rising cost-consciousness among consumers, mass merchants stand to gain the most from decreasing focus on ecommerce over the holidays. In fact,44% of consumers plan to shop at mass merchants this year, compared to 42% in 2021.

“Impulse and self-gifting are an integral part of the holiday mix, without them, it is hard to achieve growth,” Cohen said. “Success this season depends on the ability of retailers to leverage promotions and exciting products that play to feelings of shopping cheer. Increasing in-store shopping levels will deliver greater benefits to retailers that can entice consumers into buying on impulse, which could help move excess inventory out the door while also giving store bottom-lines a boost.”