Home > Insights > Press Releases > Consumers Continue to Spend at Reduced Levels Through November Holiday Promotions, Reports Circana

CHICAGO, December 14, 2023 – In November 2023, U.S. retail sales revenue, including both discretionary general merchandise and consumer packaged goods (CPG), declined 2% compared to the same month last year, and unit sales declined 3%. Discretionary general merchandise spending declines continued with 7% dollar declines and a 5% decrease in unit sales compared to last November. CPG spending gains slowed once again, with flat food and beverage revenue performance and a 1% decline in nonedible item revenue compared to last year. Demand levels have also waned, with unit sales falling 2% and 5%, respectively, in edible and nonedible segments, according to Circana, formerly IRI and The NPD Group.

“Consumers have changed the way they are shopping in response to what is going on around them, focusing their shopping energy on getting what they need at a value,” said Marshal Cohen, chief retail industry advisor for Circana. “The combination of continued price elevation, the resulting economic challenges that remain from the past few years, and the absence of newness and purchase urgency at retail have resulted in a more relaxed approach to shopping — even at the holidays.”

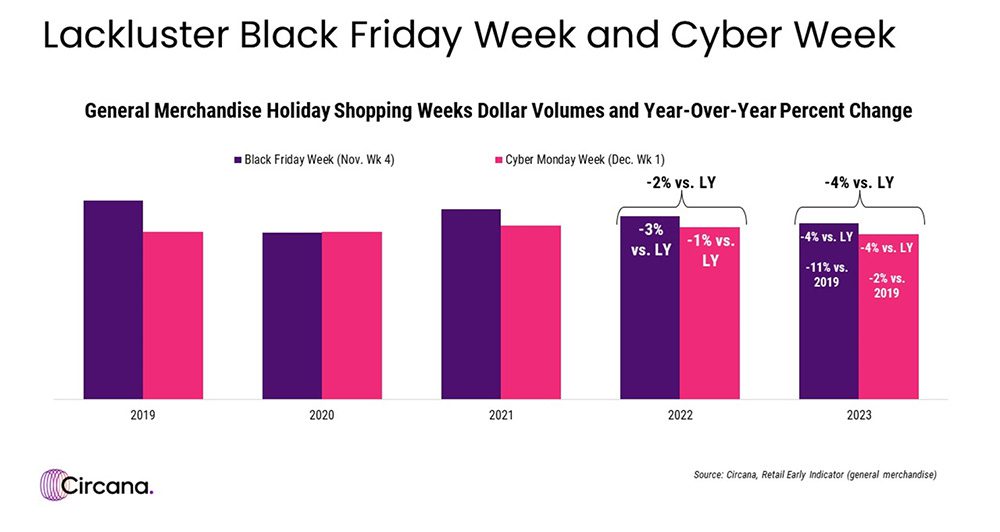

The consumer’s reduced spending level for discretionary general merchandise, a new baseline established earlier this year, is not being swayed or disrupted in a significant way by holiday shopping or promotional activity. This year’s sales revenue declined by 4% over both Black Friday Week and Cyber Week when compared to the same weeks last year.

The impact of both Black Friday Week and Cyber Week has faded in recent years as a result of the consumer’s changed buying behaviors and the extension of promotional periods. Outside of the continued sales growth of prestige beauty products, the nature of the bright spots over these two weeks differed. Over Black Friday Week, sales of some popular gifting categories, like portable beverageware and select toys, increased compared to last year. Cyber Week’s growth centered more around seasonal needs like outerwear, home comfort appliances, and auto care products.

“Holiday shopping isn’t changing consumer behavior, so retail needs to understand all aspects of spending throughout the season and make changes accordingly,” added Cohen. “This year’s holiday shopping season isn’t over yet, but the week-after-week shortfalls are leaving a lot of ground to make up, and lessons to apply when planning for next year.”