Home > Insights > Press Releases > The NPD Group: U.S. Toy Industry Retail Sales Flat in 2022

Port Washington, N.Y., January 26, 2023– The NPD Group today announced U.S. retail sales of toys generated $29.2 billion in 2022, a decrease of 0.2% or $49 million. Unit sales declined by 4% and the average selling price of $12.68 was 3% higher than in 2021. While sales remained relatively flat in 2022, the market has seen strong growth over the last three years, including 14% growth in 2021 and 17% growth in 2020. This U.S. toy industry growth contributed to a three-year compound annual growth rate (CAGR) of 10%, driven by average selling price (ASP) growth of 8% and unit sales growth of 2%.

2022 came with many challenges, including double-digit increases in food prices, rising interest rates, weather disruptions, and the ongoing threat of new COVID variants and reinfections. These factors made for a long list of shopping hurdles contributing to a muted holiday season for the U.S. toy industry. Looking at the fourth quarter specifically, dollar sales decreased by 5% or $628 million, according to NPD’s Retail Tracking Service. Unit sales also declined by 5% while ASP remained flat.

“After three record-breaking years for the toy industry, 2022 was a challenging year. U.S. consumers were forced to endure significant economic headwinds stemming from inflation and adverse macroeconomic factors,” said Juli Lennett, vice president and toy industry advisor, The NPD Group. “While these headwinds certainly impacted overall consumer behavior, the toy industry still managed to finish the year on a positive note as spending kept pace with the previous high-water mark of 2021.”

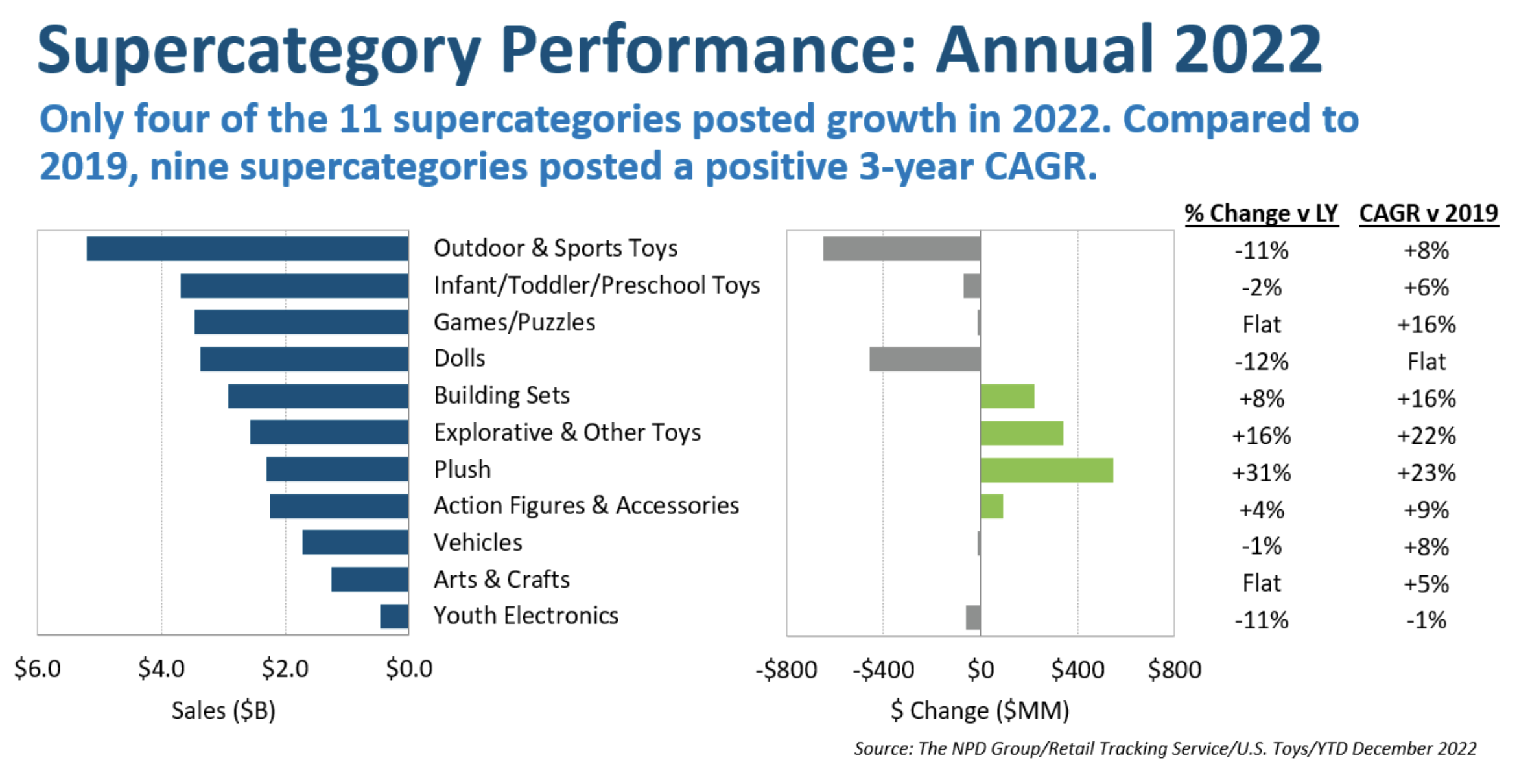

Looking at supercategory performance, four of the 11 supercategories tracked by NPD posted growth in 2022. Compared to 2019, nine supercategories posted a positive three-year CAGR. Outdoor and sports toys continued to be the largest supercategory, with $5.2 billion in sales in 2022; however, it had the largest dollar sales decline of all the toys supercategories, falling 11% year over year. It accounted for 18% of dollar sales for toys in 2022 and contributed 52% of the annual sales declines. Plush toys had the largest dollar gain of $547 million and the fastest dollar growth, rising 31%. It was followed by explorative and other toys, which grew 16%, year over year. Looking at compound annual growth rate (CAGR) compared to 2019, plush had the fastest growth of 23%, followed by explorative and other toys at 22%. Dolls had a flat three-year CAGR, while youth electronics declined by 1%.

The top toy properties of 2022 included Pokémon, Barbie, Marvel, Star Wars, Squishmallows, Fisher-Price, Hot Wheels, L.O.L. Surprise!, LEGO Star Wars, and Melissa & Doug. These top ten properties collectively grew 7%, while the rest of market declined 2%.

“Like last year, 2023 will bring about bright moments and deep groans. With a more significant theatrical calendar this year compared to the last three years, the U.S. toy industry will be poised to enjoy the fruits of several tentpole movies,” said Lennett. “However, if inflation and other adverse macroeconomic factors linger later in the year, or become worse, we can expect to see families pulling back on the number of toys they purchase or trading down to lower price points.”

marissa.guyduy@circana.com

Manager, Public Relations

Circana (formerly IRI and NPD)