Home > Insights > Press Releases > Retail Sales Hold Steady Through February, But Price Remains a Pressure Point, Reports Circana

CHICAGO, March 25, 2024 — In February 2024, U.S. retail sales revenue, including both discretionary general merchandise and consumer packaged goods (CPG), remained flat, and units declined 1% compared to the same month last year. Discretionary general merchandise spending declines continued at the newly established levels, with 5% dollar and 4% unit sales declines compared to last February. CPG performance also held steady from last month. Food and beverage year-over-year sales revenue grew 1%, and unit sales were flat. Non-edible CPG sales improved slightly, with 2% revenue growth and a 1% unit sales decline, according to Circana™, the leading advisor on the complexity of consumer behavior.

“Consumers are settling into their new spending pattern of buying what they need as they go. They are not overextending themselves financially, but they are not going without, either,” said Marshal Cohen, chief retail industry advisor for Circana. “This prioritization emerged in discretionary spending over the last two years and is now becoming evident in some of the more essential retail food and beverage spending behavior.”

Areas of the greatest growth over the past year highlight some specific consumer priorities.

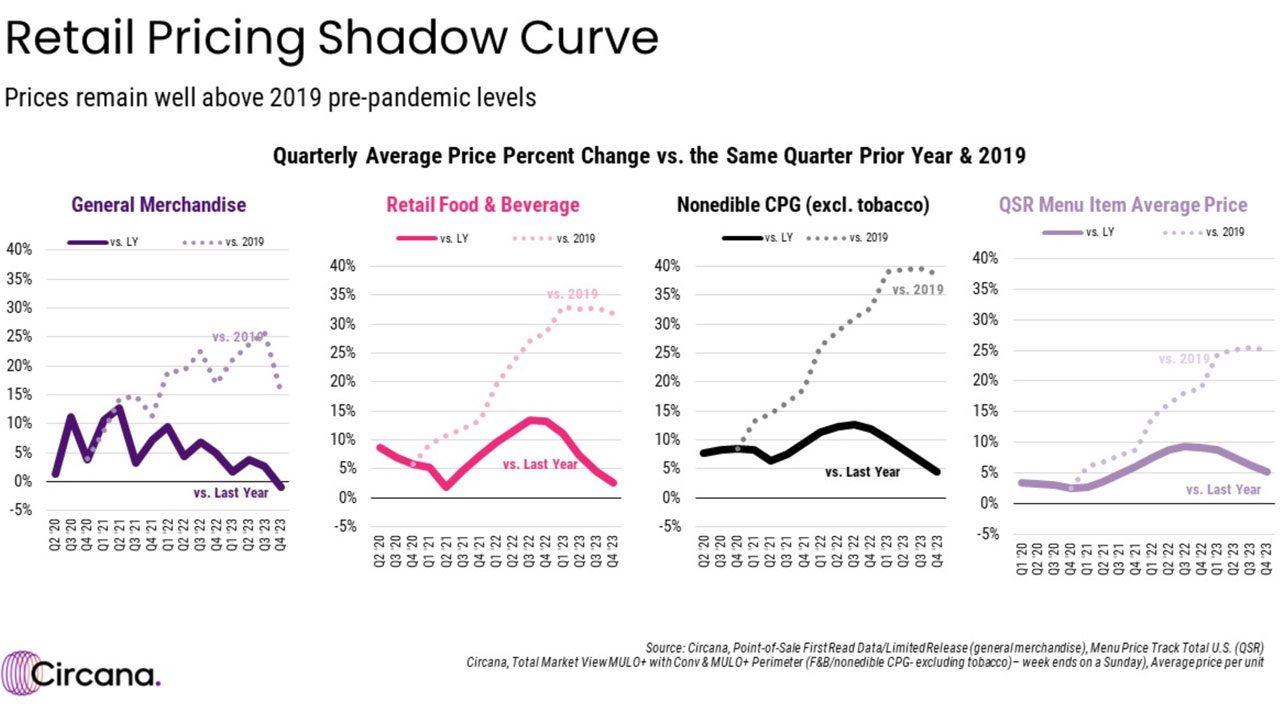

The consumer has been significantly affected by price changes across retail for the past few years. Each retail segment has at some point over the last year elevated 25% or more in price compared to 2019. While changes in general merchandise pricing are more volatile, with dramatic spending shifts compared to the evolutionary shifts in retail food and beverage, non-edible CPG, and quick-service restaurants, the influence from resulting changes in consumer behavior is just as impactful on sales volume.

“Spending on retail food and beverage has stabilized, and watching the exchange between food and general merchandise — or discretionary and nondiscretionary spending — is particularly critical,” added Cohen. “Distractions like the economy and politics are not currently instigating panic in the consumer, and changes to interest rates have yet to be realized. However, these are all realities with the potential of significantly impacting the way consumers think about their purchases, and how they prioritize and allocate their spending.”