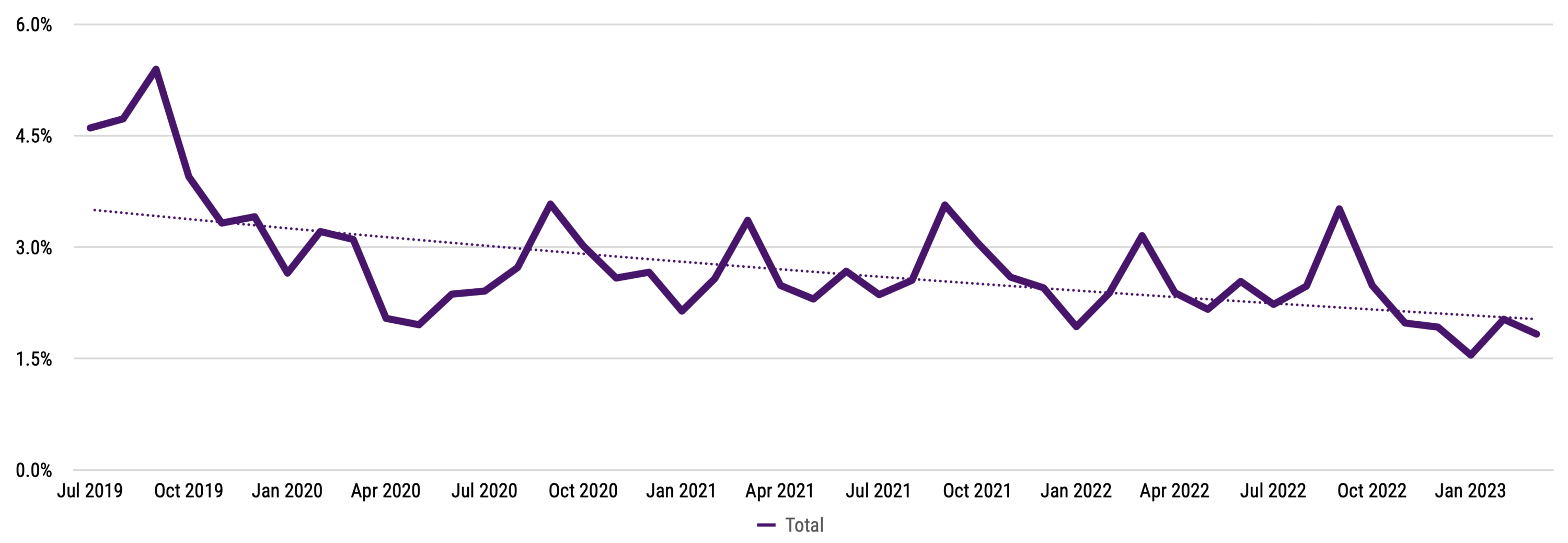

One of the biggest retail casualties of the pandemic has been the availability of new and refreshed products for consumers. Before the pandemic, new general merchandise products made up more than 5% of the market. Since then, that number has fallen to less than 2%.

New Item Count Share of Total Items (Total)

Investment in new product development was understandably put on hold during the pandemic’s uncertainty. Most companies adjusted priorities to fulfill demand when consumer spending took an unexpected upward turn. Raw goods became a challenge, so that became the priority. When demand subsided, there was too much supply, and selling became the main concern — and still no significant focus on new products.

“Consumers proved their resilience during the pandemic, spending at unprecedented levels that continued despite escalating prices. Now they’re hungry for something new,” said Marshal Cohen, chief retail industry advisor for Circana. “That means retailers and manufacturers need to have something new to offer. The ongoing sales declines cause marketers to question whether they should focus on building something new or pricing product differently. The answer is: It’s time to do both.”

Navigating Today’s Newness Dilemma

Across discretionary general merchandise and CPG, the trends in consumer spending and new product deficits in the marketplace have directional similarities, intensified by elevated prices. Compounding these consumer distractions is the economic news that continues to put vulnerability into the air.

It’s time to welcome new products and amplify newness in a big way to consumers. But it’s not solely about product innovation. Consumers respond to economic uncertainty by reevaluating their spending behavior, making it more important than ever to broadcast the value that your brand, your product, or your store brings to the consumer.

“Both the retail landscape and consumer behavior have changed dramatically over the past few years. Retail holiday sales surges are not reaching their traditional peaks,” said Don Unser, president of general merchandise and retail thought leadership for Circana. “Consumer tech, apparel, and other high-volume industries don’t consistently provide the same growth boost they once did. There is a real need for many manufacturers and retailers to shift the way they are thinking to create some spending elevation.”

Read on to learn how the lack of newness and innovation affects select general merchandise retail categories.

Apparel: newness and innovation can forge emotional connections

Kristen Classi-Zummo, Industry Advisor

The apparel industry is in danger of finding itself back where it was in 2019, with bored consumers and out-of-control promotions. With immediate fashion needs met, purchase motivators will likely shift focus to two things: innovation and joy. Consumers will crave updated silhouettes, new performance features, and fresh colors that keep them both intrigued and excited.

However, the industry is currently experiencing the opposite: Only 19% of dollars spent on apparel in 2022 went to new styles, and that’s even lower than it was in 2019, shown by Retail Tracking Service point-of-sale data from Circana. Rather than intrigue, stagnation plagues the industry. This can be attributed to a pullback in innovation, including collaboration stifled by remote work, supply chain challenges, and erratic consumer demand.

Key takeaways:

- For the past two years, we have been steadily outfitting ourselves for all facets of our revamped lifestyles. In fact, 57% of U.S. consumers continue to cite replenishment as the leading reason for their apparel purchases, shown by Circana’s latest Future of Apparel data.

- While leaning into newness is crucial, innovation has multiple meanings; it’s uniquely dependent on a brand’s core consumers and end goals.

- Regardless of the business, at the core of this quest for newness and innovation is creating an emotional connection with the consumer. In the face of whatever economic instabilities that might come our way, consumers will consistently turn to products that uplift, instill confidence, and spark joy.

For more on this topic, read Kristen Classi-Zummo’s article at Forbes.com.

Consumer electronics industry thrives on innovation

Ben Arnold, Industry Analyst

The technology industry thrives on innovation, and consumers expect to be delighted whenever they invest in a new tech product. Understandably, product development and innovation in consumer electronics have been challenged over the past few years as the industry weathered the pandemic and addressed the many demand, supply, and cost challenges that followed. Technology sales are off to a slow start so far in 2023. (Revenue through the first 13 weeks of the year declined by 13%.) However, new products and novel feature and price combinations are resonating in the market.

- The major virtual reality (VR) products on the market have been for sale for nearly three years, which is a lifetime in the technology industry. VR revenue has declined by 48% over the last six months as VR enthusiasts wait for exciting new products to come to market.

- Item trackers innovatively use Bluetooth technology to help locate lost items, like keys, wallets, or luggage. Revenue is up 31% over the past 12 months, and use cases are evolving for these products.

- In smart thermostats, a trade down in features has sparked a market shift. Less expensive models (priced below $100) that eschew premium features for more basic functionality accounted for 37% of total units in the 12 months ending February 2023, up from just 18% two years ago.

Home appliances benefit from product, marketing, and retail innovation

Joe Derochowski, Industry Advisor

In 2020, 13% of small home appliances sales were from new products to the market. Compare that to 2022, when the share fell to just 8%. It’s clear that the business challenges presented by the pandemic meant creating new and innovative products was not prioritized as highly. These days, there’s a clear and renewed need for innovation – not only in the products sent to market, but also in the way those products are marketed and sold in stores.

- Product innovation is crucial. After all, we don’t want consumers to continue to pull back on spending now that we’ve finally got them out of their homes and back in stores. More people have a hybrid work lifestyle, creating even more opportunity to find innovative ways to address the various needs of working both from offices and from home.

- Marketing innovation is another key to success. The pandemic lifestyle forced more people to go online and try out new modes of accessing news and entertainment. That’s caused changes in the marketing landscape that continue today. There is a lot of opportunity to turn home products into social media phenomena … or at least to find fresh ways to educate consumers and inspire them to solve their needs and desires in new ways with home products.

- Retail innovation sets the hook. Shopping and shoppers have changed a lot over the past few years. It’s not just that consumers have become more comfortable shopping online; they also have changed the way they shop in physical stores. It’s not really about channels anymore. It’s about how consumersget inspired, research products, make a transaction, pay for a product, have it delivered, and continue their shopping relationship.The path to purchase is being redefined. That opens up a lot of opportunities for retailers and manufacturers to work together to better meet consumers’ needs.

Footwear innovation keeps consumers interested

Beth Goldstein, Industry Advisor

The share of U.S. footwear sales revenue generated by new items (defined as items released in that same year) fell to 17% in 2022 from 23% in 2019. Footwear is an industry for which iconic and classic styles are extremely important, so it’s understandable that the majority of sales would come from existing products. However, as with any fashion category, footwear trends and brand popularity are cyclical, so it is important to keep up the pipeline of fresh product to keep consumers interested.

- Not surprisingly, the footwear category with highest percentage of sales generated by new items is fashion footwear, but that’s been declining, falling from 30% in 2019 to 24% in 2022.

- The sport leisure and outdoor categories under-indexed in the share of sales coming from new items, which makes sense given the prominence of retro and classic items in these categories. However, brands that continue to update and change those items are outperforming.

- Circana’s Future of Footwear shows the footwear market is expected to deliver only minimal growth through 2025, so growth for brands and retailers will need to come from gaining market share. Those that prioritize innovation will win.