- Marshal Cohen

- Oct 28, 2022

- 5 min read

Updated: Sep 13, 2024

With pandemic fears receding, consumers get set for holiday gatherings

Good news! Consumers feel more secure about being out among others this holiday season. NPD’s Annual Holiday Survey 2022 revealed 52% of U.S. consumers are less concerned about COVID-19 than they were at this time last year, a 20-point increase. As a result, they are increasingly looking to socialize, shop, and gather with friends and family, which will naturally spur more retail growth opportunities during the holidays. In fact, the share who plan to go to a friend’s or family member’s home for the holidays has jumped by 8 percentage points compared to last year.

“Whether it’s holiday apparel, auto aftermarket products, food and beverage, or home products for entertaining, there is a lot of potential for retailers and brands to tap into changes in social behavior over the holidays and make the most of what they have to offer,” said Marshal Cohen, NPD’s chief retail industry advisor.

52% of consumers are less concerned about COVID. 19 compared to a year ago, +20 pts from last year.

55% of consumers say they plan to host or visit family/friends during the holiday season, +8 pts from last year.

40% of consumers plan to have an overnight stay away from home over the holidays.

Source: The NPD Group/Annual Holiday Survey, 2022.

Kristen Classi-Zummo, Apparel Industry Analyst

Gathering with friends, family, and colleagues will be at the top of our to-do lists this holiday season. As a result, we can expect sustained growth in dressing up throughout the rest of the year. However, as prices continue to rise across the board, the apparel industry needs to be laser focused on what’s driving consumer demand during the upcoming season. Expect hot brands, new trends, and wardrobe needs (like going to events and a change in weather) to drive consumers to spend on apparel. For many categories, consumers are being clear and deliberate with their spending — either they want it and they’ll buy it, or they don’t and they won’t.

Economic headwinds chill consumer sentiment

Even as consumers report feeling safer going out in the world again, increasingly negative perceptions about the economy and their own personal finances is leading nearly one-third (29%) of U.S. consumers to consider spending less during the holiday shopping season. While most shoppers plan to spend the same amount or more than last year, the share of those who plan to spend less has grown by nearly 4 percentage points over last year.

Consumers are feeling less optimistic about their holiday spending than they were just a year ago.

Holiday Spending Intentions % Among Total Respondents

Q1. How much do you plan to spend on holiday shopping this year? Q2. Compared to last year, do you plan to spend … ? Source: The NPD Group/Annual Holiday Survey

This negative shift is echoed by younger households that are more concerned about inflation affecting their holiday spending, shown by data from Information Resources, Inc. (IRI), which recently merged with NPD to create a leading global technology, analytics, and data provider. In fact, 23% of Millennials and GenX consumers — compared to 10% of older consumers — are worried that higher prices might affect their ability to afford their usual holiday celebrations.

“Economic uncertainty is leading some consumer groups to think twice before spending, including high-income consumers who have managed to shore up retail industry sales throughout the pandemic,” said Don Unser, president of general retail merchandise thought leadership for NPD. “While high-earning shoppers will certainly demonstrate more resilience, those with lower incomes will have a tougher time staying within their holiday shopping budgets.”

Paul Gagnon, Consumer Technology Industry Advisor

With inflation driving price increases for everyday necessities, consumers expect to spend fewer dollars this holiday season on core tech products like TVs and notebook computers — either due to recent declines in average sales prices or because they are diverting budget away from these products. Interest in core holiday tech stalwarts, like TVs and headphones, are slightly down from last year, but we expect TV unit sales will still see modest growth due to strong holiday promotions. This year, as consumers prepare to spend more time away from home, intent to purchase smartphones during the holiday shopping season is up and interest in purchasing smartwatches is at a three-year high.

Early October promotions stretch the season

It is important for retailers and marketers to recognize the elongated holiday shopping season and the business opportunity that goes along with it. Receding COVID-19 concerns and increased social engagement, combined with rising prices and financial fears, could lead to additional spending disruptions as consumers manage climbing credit card debt. Emphasizing product availability and providing price assurance will help to spark earlier consumer engagement.

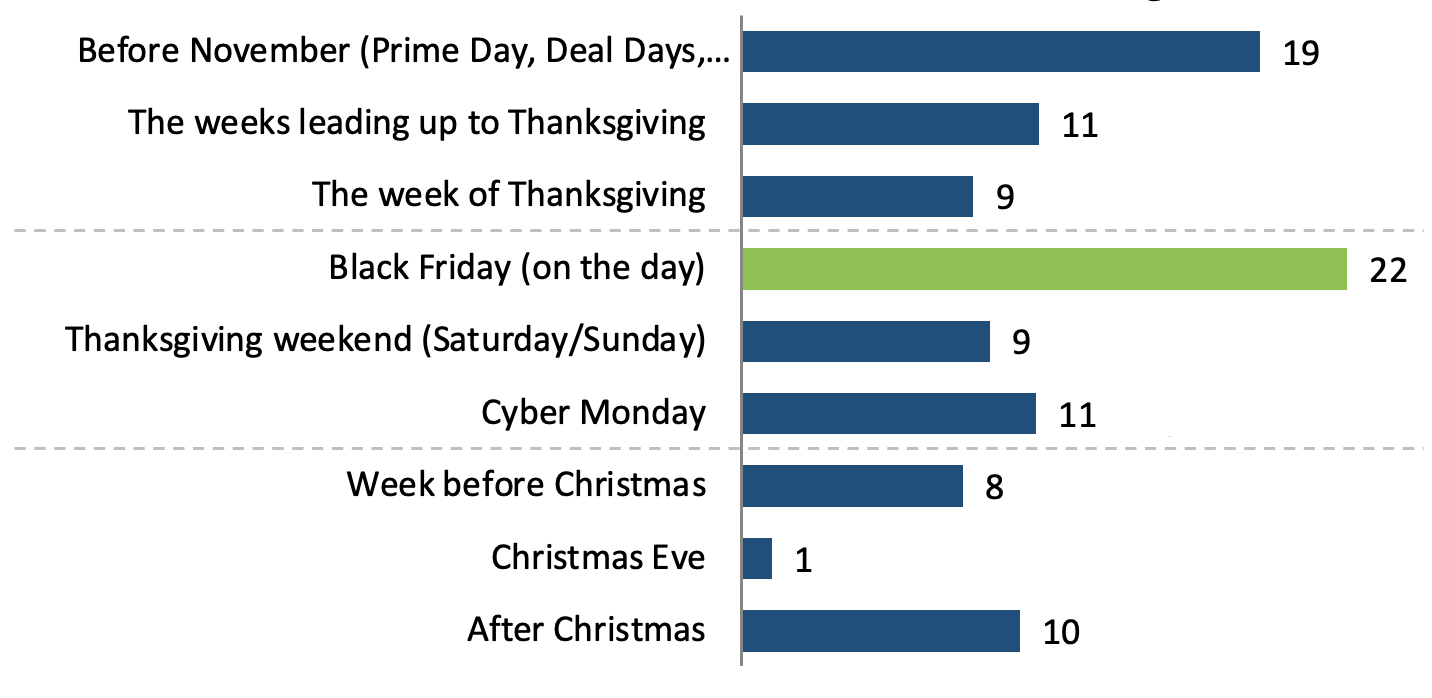

Best Deals for Holiday

% Among Total Respondents

Q12b. Will you do any of your holiday shopping on the October Prime Day? Q12d. Thinking about the different times that you can shop for Holiday, during which of the following time periods do you feel you will get the best deals possible? Source: The NPD Group/Annual Holiday Survey *The NPD Group/Checkout Omnichannel Tracking

“Pre-holiday promotions will jump-start the holiday shopping season and boost the lagging fall season,” Cohen said. “The weather has started to cool across much of the country, and consumers who became accustomed to almost unlimited spring and summer sales will be looking for fall and winter fashion deals. These promotions will get consumers thinking even earlier about their holiday shopping lists and how to save money, as the cost of living continues to rise.”

Joe Derochowski, Home and Home Improvement Industry Advisor

The large-scale retailer promotions in October give consumers more time for holiday shopping. Some will want to start early, motivated to save money by the mid-summer Prime Day-related sales and now by Prime Early Access and other large-scale promotions in mid-October. Because deal-oriented shoppers might start early, Black Friday and Cyber Monday sales could be adversely affected, but there are always consumers who shop the post-Thanksgiving sales because it’s become a traditional holiday activity. Like last year, we can expect lots of last-minute shopping, especially for high-quality products in the personal care category (e.g., massagers, electric toothbrushes, etc.). Although there might be fewer unit sales this year, higher prices mean sales revenue will likely track similarly or even higher than last year.

Looking Backward to Navigate Forward

Four-year Trend through December

Weekly Dollar Volume Trend ($B) Week Ending January 12, 2019 – through Week Ending October 1, 2022

Source: The NPD Group/Point-of-sale first-read data, limited release. Discretionary retail includes the following industries: accessories, apparel, auto parts, beauty, consumer technology, DVD/Blu-ray, footwear, housewares, juvenile products, office supplies, small appliances, sports equipment, toys, video games.

While many retailers and brands are looking at last year’s holiday season before placing their bets this year, 2019 might be a more fruitful comparison, shown by NPD’s Retail Early Indicator data. Even with stronger economic headwinds this year, the retail industry has settled into a more normalized spending cadence not seen since before the pandemic. Due to higher prices for retail goods, food, and fuel, holiday discretionary retail sales might not exceed the high peaks seen three years ago, but spending is still tracing a similar path over time.

“We’ve noted consumers’ resilience ever since the pandemic began, and that it should not be underestimated,” Cohen said. “In fact, we’re expecting retail sales revenue growth of 1% to 2.5% over the elongated holiday season, compared to last year. Consumers might end up buying fewer products overall, but higher prices for the products they do buy will once again shore up retailers’ bottom lines.”